Commvault reported robust Q2 FY2025 earnings, showing strong growth across key metrics and solidifying its cloud and cyber resilience position. The company’s revenue grew 16% YoY to $233 million, its fourth consecutive quarter of double-digit growth, while ARR and free cash flow showed substantial increases. Key strategic initiatives around cloud-first resilience, multi-cloud capabilities, and deepened partnerships underscore Commvault’s commitment to continuous innovation in a dynamic, threat-heavy cloud landscape.

Let’s take a look at what the company announced.

Key Financials

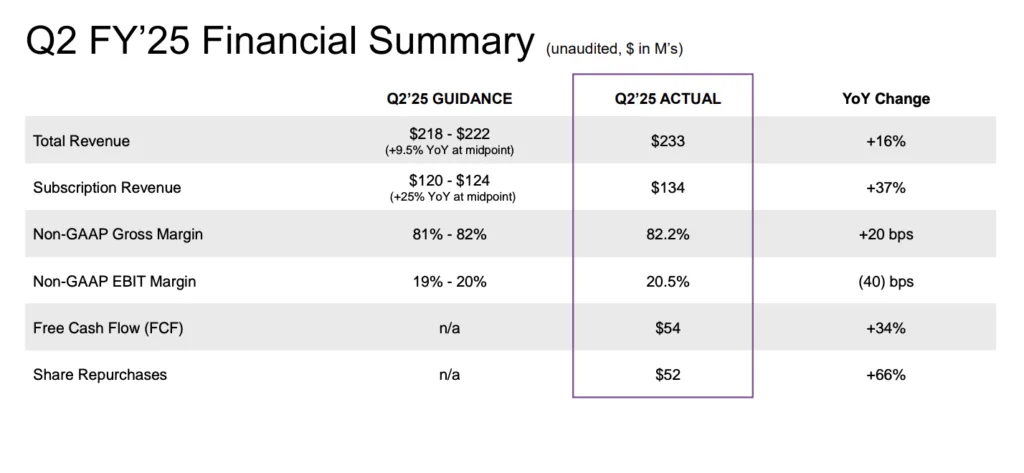

Commvault reported a strong financial performance in Q2 FY2025, marked by double-digit growth across key metrics:

Revenue Growth

- Total Revenue reached $233 million, a 16% increase YoY, marking Commvault’s fourth consecutive quarter of double-digit revenue growth.

- Annual Recurring Revenue (ARR) increased 20% YoY to $853 million, with notable growth in subscription-based revenue.

- SaaS ARR grew by an impressive 64% YoY to $215 million, now representing 25% of total ARR.

Subscription and SaaS Growth

- Subscription ARR rose 30% YoY to $687 million, highlighting a substantial shift towards recurring, cloud-based revenue models. This growth was fueled by both SaaS offerings and traditional software subscriptions.

- SaaS Growth Drivers: Commvault saw increased traction from its newer SaaS solutions, such as the recently launched Cloud Rewind, which supports rapid data recovery for cloud environments.

Profitability and Cash Flow

- Free Cash Flow rose 34% YoY to $54 million, with 97% of this cash flow returned to shareholders through share repurchases, signaling strong financial health and efficient capital management.

- Operating Margins: Commvault’s improved operational efficiency was evident as it managed strong revenue growth alongside robust cost control, contributing to margin stability.

Non-Fiscal Highlights

- Cloud-First, Continuous Resilience Strategy: Commvault continues to innovate within its “continuous business” model, a proactive approach that addresses the need for resilience in cloud environments.

- Commvault Cloud Rewind Launch: Highlighted at Commvault’s Shift event, Cloud Rewind gives Commvault nice differentiation in cloud recovery. Utilizing capabilities from the Appranix acquisition, Cloud Rewind allows users to quickly discover, map, and recover cloud data and applications, emphasizing both breadth and speed, capabilities aligned with market demands for rapid recovery solutions.

- Enhanced Cyber Resilience for Critical Assets: Commvault announced automated recovery for Active Directory to bolster cyber resiliency to streamline the recovery process post-attack.

- Strategic Partnerships:

- AWS and Google Cloud: Commvault extended its collaboration with AWS, incorporating Clumio-acquired technology to strengthen Amazon S3 data resilience. Integration with Google Workspace allows Commvault to support comprehensive data protection across Google’s suite, complementing its existing Microsoft 365 protection.

- Pure Storage Collaboration: In preparation for the EU’s Digital Operational Resilience Act (DORA), Commvault’s partnership with Pure Storage aims to enhance resilience and compliance for financial services. The joint offering focuses on cyber recovery and risk management, addressing regulatory demands in cloud-based environments.

Guidance & Outlook

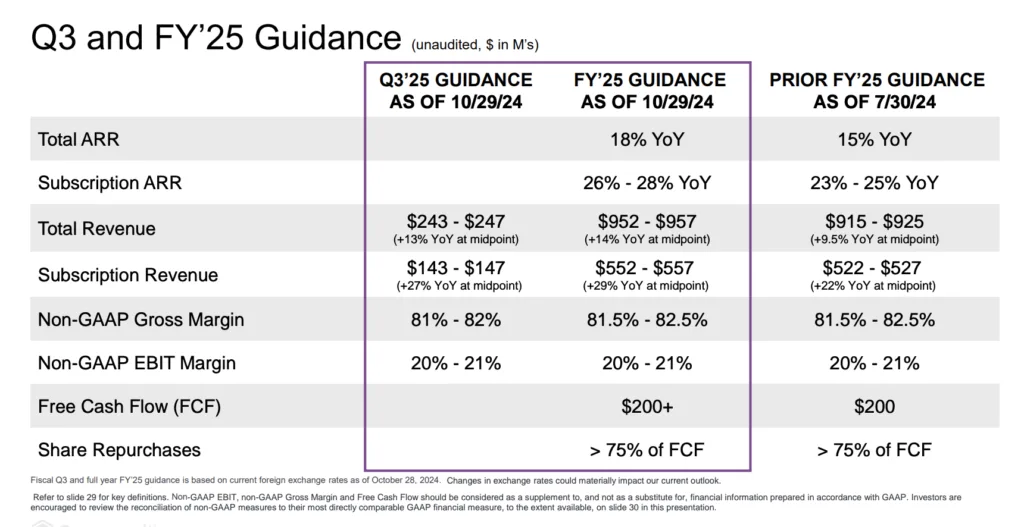

Commvault raised its FY2025 guidance based on strong first-half results and positive customer response. The company expects ARR to grow approximately 18% YoY, with Subscription ARR forecasted to increase by 26-28%. Total FY2025 revenue is anticipated to reach between $952 million and $957 million, reflecting a 14% YoY increase.

Analysis

Commvault operates in a highly competitive and evolving market focused on data protection, cloud backup, disaster recovery, and cyber resilience solutions. The company faces several notable competitors, including Veeam, Veritas, Rubrik, and Cohesity, each targeting enterprise needs for data security, recovery, and cloud management. Commvault’s differentiation lies in its emphasis on multi-cloud agility, deep integrations with leading cloud providers, and advanced cyber resilience features.

A key area of differentiation for Commvault is its continuing innovation in cyber resilience and cloud-native flexibility. Its ability to integrate across major cloud environments, meet regulatory needs, and offer strong cyber resilience features gives it a competitive edge. However, the company must continue differentiating against competitors by rapidly scaling its SaaS capabilities and multi-cloud support.

Commvault’s Q2 performance shows that the company is successfully transitioning to a subscription-based, cloud-first model with strong revenue growth, expanding ARR, and increased profitability. The company’s focus on cyber resilience, cloud recovery, and regulatory compliance aligns well with customer needs in the current threat landscape, solidifying its competitive position.

Commvault’s focus on cloud-native cyber resilience and multi-cloud capabilities keeps it well-positioned in a market increasingly concerned with data security and compliance. Its commitment to innovation and agility, demonstrated through product launches and strategic partnerships, strengthens its competitive positioning. Commvault’s offerings around continuous resilience, SaaS growth, and regulatory compliance will resonate strongly as organizations across sectors shift to cloud-first approaches.