Background

A well-fielded survey can reveal truths about the market that you won’t find otherwise. Sometimes you’ll find that it validates assumptions you already hold, but other times a good survey will shine a light on something completely new. NetApp’s just-released 2023 Cloud Complexity Report does both.

News: NetApp’s 2023 Cloud Complexity Report

IT organizations are asked to do more with less in our current challenging macroeconomic environment. As a result, demands on IT resources are increasing, all while staffing and infrastructure investment must be fought for.

In addition, after more than a decade of enterprise adoption, IT organizations are coming to terms with the inherent complexity in deploying to the public cloud. NetApp’s survey reflects this new reality.

Increasing Complexity. And Skepticism.

I like that NetApp includes the word “complexity” in its title because that truly reflects the challenges of managing IT resources across a multi-cloud infrastructure. NetApp’s survey revealed that 98% of global IT executives report that their organizations have been impacted by the increasing complexity of managing data across the cloud. This may seem obvious, but the survey goes a level deeper. This is where some surprises surface.

Factoring into the complexity facing IT organizations are the usual suspects of increased cybersecurity risks, budget concerns, and staffing issues. Most surprisingly, 44% of survey respondents noted increased skepticism over cloud adoption from leadership. This was coupled with 44% of respondents saying that staff isn’t taking full advantage of business applications in the cloud.

Increasing Tension Around Cloud ROI

I was fortunate to speak to Ronen Schwartz, NetApp’s Senior Vice President and General Manager of NetApp’s Cloud Storage business. I talked to Mr. Schwartz just before the report was released, and I asked him what, in the results, surprised him most.

Ronen Schwartz told me his biggest surprise is that short-term return on investment is now a top-tier concern for IT administrators. This is a shift from recent years, where the top driver revolved around agility and solving complexity. But times have changed.

According to NetApp, 84% of technology executives are already expected to show returns on cloud investment or are under pressure to deliver short-term progress. This is coupled with the 76% of respondents who indicated that their business leaders are “somewhat to extremely skeptical” of seeing cost savings.

NetApp went a layer deeper and showed that while pressure to show RIO is common (33%), it’s highest where business leaders are most skeptical (44%). Adding additional color, the survey indicates that pressure over higher ROI tends to come more from director-level management, who are closer to the day-to-day operations, than from C-level executives.

Cloud Grows, Despite Skepticism

While management is increasingly skeptical about cloud adoption and is demanding a faster ROI, cloud adoption continues to grow. The agility and flexibility the public cloud offers is compelling, especially compared to CapEx-driven on-prem infrastructure. When looking at why organizations deploy to the cloud in 2023, NetApp’s survey yielded several expected answers but also one that surprised me.

The Rise of AI

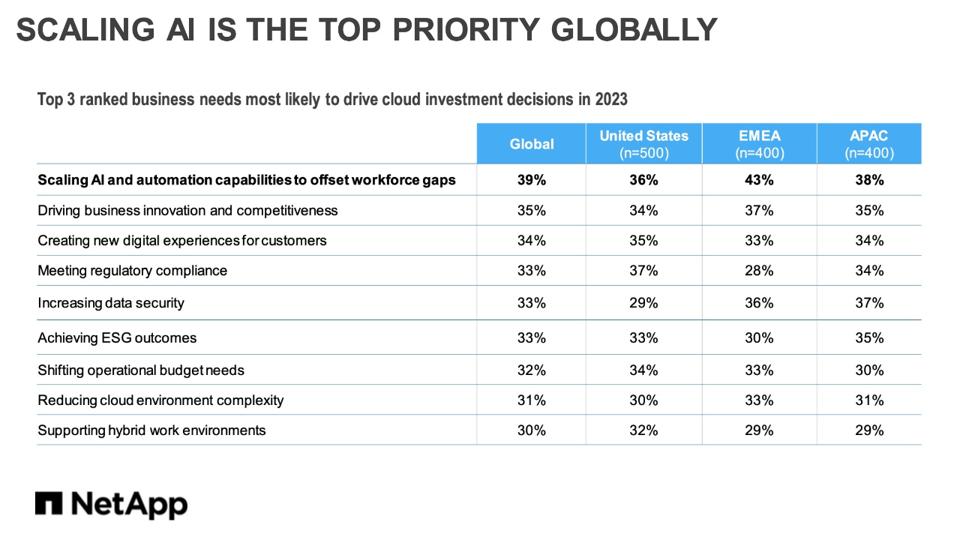

Scaling artificial intelligence and automation s is the top-ranked business need most likely to drive cloud investment decisions in 2023. This sits above well-known drivers such as regulatory compliance, data security, ESG, budget, and operational complexity. Nearly half of technology executives surveyed in the United States report that “half or more” of their cloud deployments will be supported by AI-driven applications over the coming year.

AI is seen as critical to delivering multiple business benefits. According to this survey, the top benefits are using AI to achieve greater security and risk assessment, improved customer experience, and increased production rate. This survey was fielded before the current excitement around large language models, such as ChatGPT, but my guess is that LLMs deliver these same benefits.

Analysis

It wasn’t that long ago that the public cloud was seen by IT leadership as a path for reinvention. It promised a flexible consumption model, paid for easy-to-budget OpEx. Everything was going to move to the cloud, all of us technology analysts promised.

NetApp’s survey shows that corporate leadership is recognizing that the reality of the public cloud is far messier. This is good news for IT, as it indicates that conversations about cloud adoption are now grounded in reality.

It’s also good news for companies like NetApp, whose offerings remove some of the complexity inherent in public cloud deployments. NetApp’s cloud business brings NetApp’s data and storage management solutions to the top public cloud providers. So whether we’re talking about enterprise cloud storage with NetApp’s ONTAP cloud volumes, NetApp BlueXP for managing the hybrid-cloud experience with a unified control plane, or its multiple data protection and cyber-resilience technologies, NetApp has a strong play in the public cloud.

The market is responding. In its latest earnings, NetApp reported that is public cloud ARR is now $605M, up 29% from the prior year. Actual revenue from the public cloud for the quarter was $150M, up from $110M. The company’s cloud partnerships only continue to grow.

The multi-cloud environment is only becoming more complex. Consumption-based on-prem offerings such as Hewlett Packard Enterprise’s GreenLake and Dell Technologies APEX are increasingly challenging public cloud. In addition, NetApp has its own storage-as-a-service, NetApp Keystone. These solutions co-exist with the public cloud, a key element in nearly every enterprise’s infrastructure.

Understanding the complexity of multi-cloud is paramount to solving the problems of working IT practitioners. NetApp’s survey demonstrates that the company is working to understand these needs better. This will only make NetApp’s solutions better.