Companies mentioned: Amazon, AWS, Cisco, CoreWeave, Databricks, Ericsson, Flex, Google, HPE, IonQ, JetCool, Lenovo, Meta, Microsoft, Nokia, NVIDIA, OpenText, Palintir, Pure Storage, Qubitekk, Rapid, SpaceX, VAST Data.

Every week we send a newsletter to our list of tech industry insiders. Here’s an excerpt of what we shared for the week ending November 17:

Driving the Week

Growing well beyond its HPC roots into AI and other performance-driven infrastructure needs, SC24 is happening in Atlanta this week. We’ve been pre-briefed on a few of the announcements going out at the event and know it’s going to be a good one for infrastructure watchers.

We’ll also be on-site at OpenText World in Las Vegas, where the focus is on the next generation of enterprise data management. Fun fact about OpenText: the company grew out of a project at the University of Waterloo that was developing technology to index the Oxford English Dictionary. No word on whether they were successful.

Microsoft also hosts its annual tech-focused Microsoft Ignite event in Chicago where the theme is (what else?) “AI Innovation.”

There’s only a smattering of earnings this week, but they’re big ones: Hotly anticipated numbers from NVIDIA arrive Wednesday, along with Palo Alto Networks and Snowflake. On Thursday we’ll see earnings from NetApp and Elastic.

Overheard

Delays for NVIDIA’s Blackwell Systems? Ahead of NVIDIA’s earnings this week, tech news outlet The Information is reporting that “in recent months” NVIDIA asked suppliers to change the designs of racks supporting its new GB200 Blackwell-based systems to “keep them from overheating.”

Two executives at “large cloud providers” told The Information that this may push out deployment, saying that “they need at least several weeks to test the system and iron out possible kinks.”

We’ll wait to hear what NVIDIA has to say on its earnings call, but we were there at Lenovo Tech World last month when CEO Jensen Huang told the room that the company is already shipping parts to its hyperscale customers.

Is this a signal there’s no IPO on the near horizon? One of the industry’s most valuable private companies is looking to raise money to help employees who have stock grants set to expire over the next 18 months. Databricks, long expected to IPO, is set to raise an unspecified amount of money targeted at employee share buy-backs.

Word on the street is that it wants a funding round at a $55 billion “or higher” valuation, a number validated by a Reuters, who reports Thrive Capital is “in talks” to acquire about a $1 billion stake in Databricks at precisely that valuation.

Minority Reporting: The Financial Times learned from data obtained through FOIA requests that government-focused AI company Palintir “has been in talks with the Ministry of Justice about using its technology to calculate prisoners’ ‘reoffending risks’.”

For its part, the company says that its only looking to provide a “single, constantly updating source of truth for prison capacity across the UK.” This one’s continuing to develop, and is a continuation a long-lasting dialog about how much we entrust AI to critical social concerns.

Nuclear Powered Data

A rough start to the nuclear-powered AI arms race: The Financial Times reports that Meta’s planned a nuclear-powered data center is being scrapped due to the discovery of a rare species of bees on the land allocated for the project.

Amazon’s AWS also hit a snag on its planned nuclear datacenter in Pennsylvania, with the US Federal Energy Regulatory Commission (FERC), who oversees such things, rejecting the plan, saying that the project “would set a precedent which may affect grid reliability and increase energy costs.”

This doesn’t stop nuclear efforts. CSP Google is bypassing the power-grid all together, recently saying that it’s order a half-dozen small modular nuclear reactors from US startup Kairos Power. Meanwhile, Microsoft announced last month that it’s reviving the long-shuttered Three Miles Island nuclear plant in Pennsylvania.

Deals

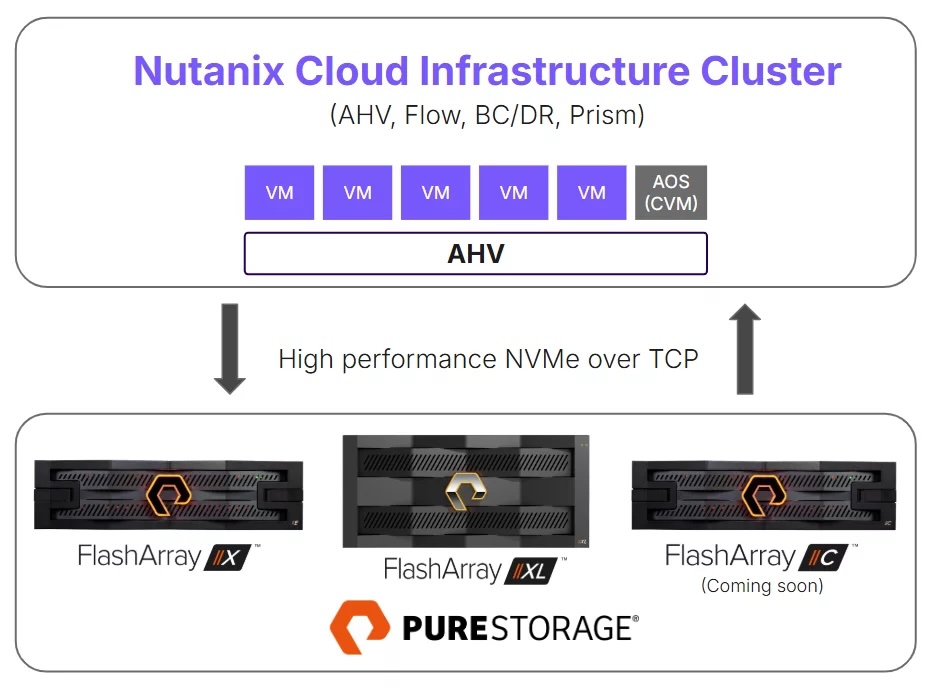

Tripling its valuation, specialty GPU-cloud provider CoreWeave closed a $650 million secondary share sale at a reported $23 billion valuation. Beyond money from expected investment players, this round also saw investment from Cisco and Pure Storage.

Pure’s press release about the investment noted that this is part of a larger “strategic collaboration” with between the companies, saying that the deal “enables customers to leverage the Pure Storage Platform within the CoreWeave Cloud.” We don’t yet know what that means for VAST Data, the long-time incumbent in the CoreWeave Cloud.

Keeping it cool, contract manufacturing giant Flex announced the acquisition of long-time partner JetCool, a leading player in the quickly gorwing liquid-cooling market, for undisclosed amount. It’s a strong acquisition for the Flex.

And we were just figuring out IPv6: Quantum computing pioneer IonQ is buying all the “operating assets” of quantum networking start-up Qubitekk for an undisclosed amount. The deal includes Qubitekk’s team, which will transition over to IonQ when the deal closes in “six months.”

Connectivity

Will 5G APIs Unlock New Revenue or Telcos? 5G standalone (SA) spending is slowing as companies reassess their budgets after disappointing returns on investment. But don’t worry—APIs are here to save the day! They’re going to be the secret sauce for unlocking new exciting (and revenue generating) use cases for 5G.

Nokia is on board with the API revenue approach and has acquired an industry 5G API leader, Rapid. APIs are deeply collaborative and will drive much needed innovation in the 5G arena. Nokia’s investment in APIs may be a rising tide that lifts all boats, fostering collaboration and innovation that will propel the entire 5G industry forward.

Ericsson bets $450 Million on Future Wireless Technology: While 5G struggles to maintain its momentum, Ericsson’s expanded its commitment to developing future wireless connectivity. The company announced that it has invested more than $450 million to enhance its two R&D facilities in Canada. The investment will create hundreds of jobs that will focus on developing 5G Advanced, 6G, wireless APIs, Cloud RAN, and AI technologies.

The API race is heating up folks. The technology is here, and major wireless players are making significant investments, setting the stage for clear winners and losers in the race to capture the API market. So, keep an eye on developments in this segment of the industry!

What We’re Reading

In a time when DEI initiatives are being cut across the tech, Business Insider talks to HPE CEO Antonio Neri about his views on the topic and how HPE is bucking the trend. Neri believes that diversity in HPE’s 62,000-strong workforce is important, pointing out that:

“When he took over the CEO job in 2018, all 12 of Neri’s direct reports were male. It took seven years, but that group is now 50% female and so is HPE’s board. Across the company, women hold nearly 28% of director-level or above positions.”

Continuing to analyze the US elections, TechCrunch looks at “What a second Trump term means for the future of ransomware.” It’s a good read on some non-obvious implications to the cyber-security community.

Enough Starlink? Connectivity-focused outlet LightReading’s piece “Researchers urge FCC to stop LEO launches until further review” looks at a letter to the FCC written by more than 100 researchers, including from such institutions as Harvard, Princeton, Yale, and the University of Texas at Austin, urging the FCC “to pause” low-earth orbit (LEO) satellite launches, noting “environmental harms of launching and burning up so many satellites aren’t clear.”

The piece notes that SpaceX has launched more than 6,000 LEO satellites in the past five years (account 60% of all satellites) and that “an estimated 58,000 satellites will be in orbit by 2030, with hundreds of thousands more expected based on plans from SpaceX, Amazon’s Project Kuiper and others.”

Last up, the Wall Street Journal makes friends with a chatbot in fun piece “So Human It’s Scary: My Day Alone Talking to Bots That Sound Like Us.” We won’t spoil the fun, except to say that author Joanna Stern writes, “It’s like an episode of ‘Friends,’ except these besties don’t live across the hall, they live on my phone. (I’ll be there for you, as long as the servers are up.)”