Background

Quantum Corporation jumped head-first into the scale-out file and object storage market earlier this month by announcing its new Quantum Myriad all-flash storage solution. It’s no surprise that Quantum is moving deeper into the file and object space, but it is surprising that it’s done so with such an advanced offering.

Core to Quantum’s long-term strategy is delivering an end-to-end solution stack for storing and managing unstructured data. The company, which has offerings ranging from tape archive products to high-performance software-defined share-nothing storage, rounds out its portfolio with the new Quantum Myriad. Myriad is a high-performance, high-capacity file and object storage solution.

News: Quantum Myriad

We’ve been waiting for Quantum Myriad since last November, when Quantum’s Chief Development Officer, Brian Pawloski, teased it at Quantum’s investor analyst conference. Brian told us then that managing the increasing deluge of unstructured data requires “a completely different storage architecture and advanced data services, designed from the ground up to be cloud native […]; a scale-out solution based on containerized microservice implementation.” Finally, Brian and team delivered that vision with Myriad.

Microservices-based Architecture

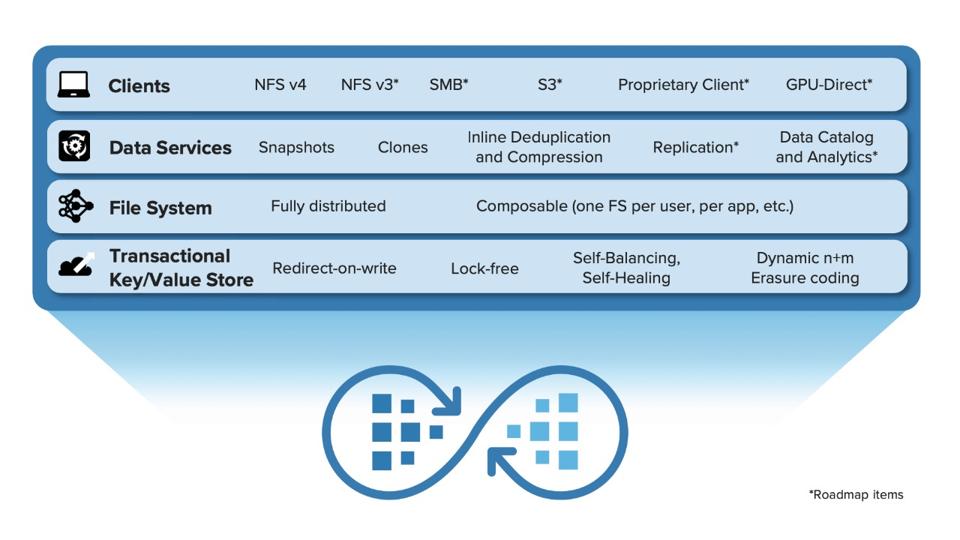

Quantum Myriad is an all-flash shared-nothing scale-out file and object storage solution designed for the enterprise. The software stack inside the new offering is based on a microservices architecture with Kubernetes-powered orchestration. This approach gives Quantum the unique flexibility to move the functionality to new platforms, including the public cloud, as market needs shift.

The Myriad offering delivers most of what you want to see in a robust scale-out file and object solution. This includes always-on inline deduplication and compression, snapshots and clones, and metadata tagging for accelerated AI/ML and advanced analytics. The pieces missing at launch, such as S3 object semantics and SMB file sharing for Windows, will be available in a post-release software update.

Scale-Out Architecture

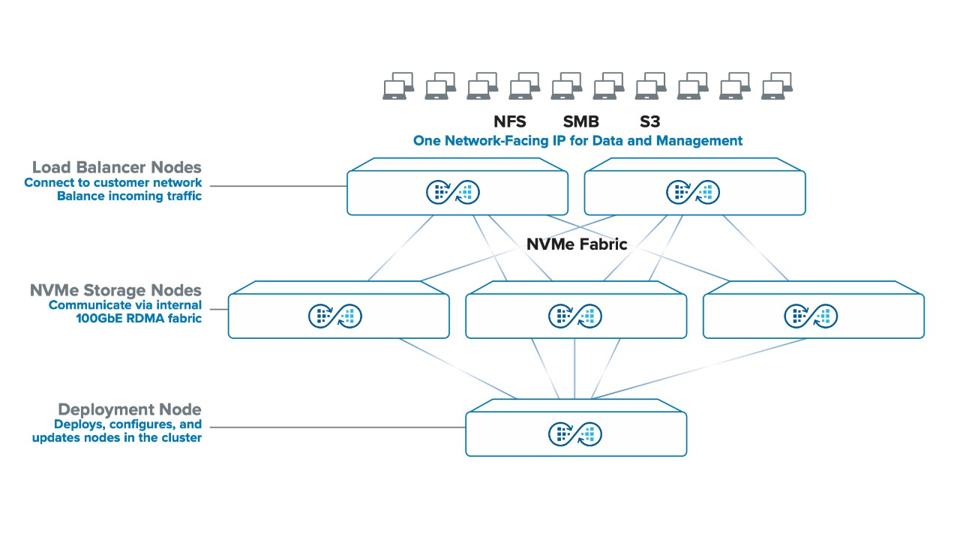

Myriad is initially being delivered as Quantum-supplied appliances. Quantum tells us that, apart from its software, there is no magic in the hardware. Myriad runs on standard x86 servers deployed in a clustered architecture. Quantum connects the cluster nodes with an internal fabric constructed of 100GbE RDMA network adapters. The network is internal to the cluster and pre-configured, simplifying the installation.

There are three types of nodes within a Myriad cluster:

Load Balancer Nodes connect to the customer network, routing traffic from external devices to the storage nodes best equipped to handle the traffic. The Load Balancer Nodes also get involved in internal cluster traffic, which should be invisible to the user.

NVMe Storage Nodes manage and store data. Each storage node has access to all the NVMe drives within the cluster, allowing each node to service storage requests regardless of the physical location of the underlying media. This gives Myriad near-seamless scalability.

The Deployment Node is Myriad’s management node. It configures the cluster, manages software upgrades, and performs similar administrative functions.

Quantum didn’t disclose any performance numbers or configurations, but the company’s approach with Myriad should offer near-linear scalability with predictable latency numbers. The performance will only be gated by the hardware on which Quantum chooses to deploy the solution. I expect it will be competitive with the best that Dell Technologies can deliver with its similar Dell PowerScale offerings.

Analysis

With Myriad, Quantum now has an enviable line-up of storage solutions that span one the largest tape archive businesses in the industry to high-performance scale-out file and object storage. The company has the right set of products to grow. The focus now is on execution. And on answering the question of how much share Quantum can take from its competitors.

Quantum’s Momentum

Quantum has been around for a long time. It was founded in 1980, and you might be surprised to learn that there was a time in the 1990s when the company was the world’s largest producer of hard disk drives. However, the modern era for Quantum really started in 2018 when Jamie Lerner joined as its chief executive.

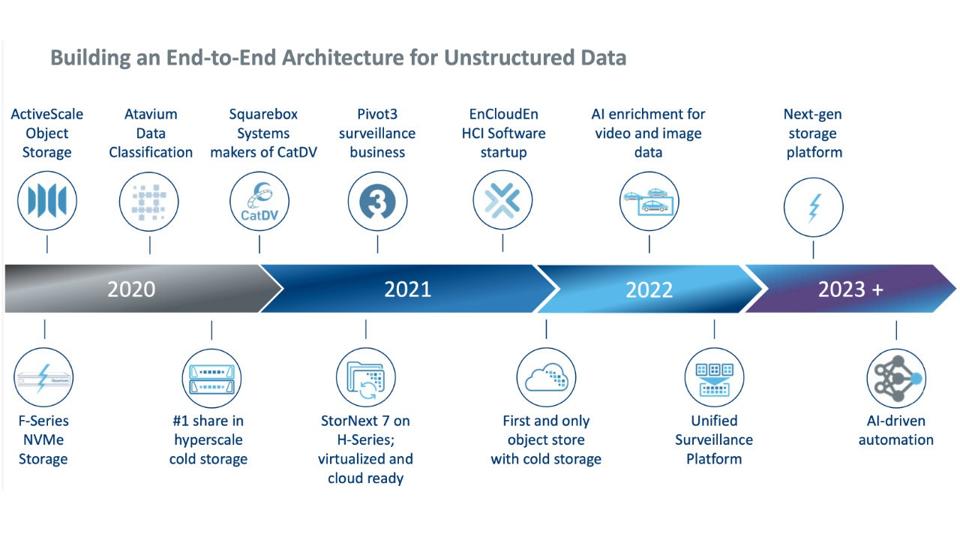

Lerner laid out a plan for Quantum to become a full-stack storage provider, and for the past five years he’s overseen an impressive period of growth and operational excellence. Under his leadership, Quantum has acquired five companies in less than three years. While these acquisitions quickly yielded top-line revenue growth, they have, more importantly, become the foundation for delivering on a bigger vision – one that is paying off.

In its most recent quarter, Quantum reported $111.2M in revenue. That’s an increase of 17% year-on-year (12% sequentially) and the highest quarterly revenue since Lerner joined as CEO. In addition, its subscription ARR grew 84% year-on-year to $11.2M. The raw numbers may be small when compared to industry leaders such as Dell Technologies or Hewlett Packard Enterprise. Still, this is exactly the numbers you want to see in a technology growth company, even one reinventing itself after 43 years in the world.

Competitive Environment

The unstructured data market is crowded with big players. Dell Technologies, for example, shipped $5B of storage products in the last quarter of 2022. While crowded, this market also likes choice and is responsive to technological superiority. Companies like Pure Storage and Lenovo continue proving that as they outgrow the overall market. There’s little doubt that Pure’s growth comes at the expense of Dell, HPE, and NetApp.

Quantum’s big question is whether it can take business from its larger competitors with its new Myriad offering. Quantum has an interesting and diverse footprint the market. For example, it has a strong business in media and entertainment, but also in surveillance video. Quantum is also one of the world’s largest providers of tape archive technology, selling a tremendous amount of product into the public cloud.

Quantum Myriad competes directly with Dell’s PowerScale, Pure Storage’s FlashBlade, HPE’s new GreenLake for File Services, and even VAST Data’s Universal Storage platform. That’s a heady list of competitors, though there’s plenty of business to go around. According to IDC, the total scale-out file and object storage market will exceed $15B by 2025.

The Analyst’s Take

Quantum’s new Myriad is a nice offering for a growing market that is receptive to choice. The biggest challenge facing Quantum is bringing Myriad into new verticals. This is an enterprise-class offering. Can Quantum crack the enterprise? That’s a tricky question to answer.

I predict Quantum will succeed early in its core verticals, such as media and entertainment. These should be easy sales that will displace the mostly-Dell machines currently servicing those workloads. In addition, I like Quantum’s leadership. CEO Jamie Lerner has shown tremendous discipline in marching towards its strategic vision. I expect he’ll continue to do fine as Myriad opens new doors for Quantum.