CrowdStrike demonstrated remarkable resilience in its latest quarterly earnings report, overcoming significant challenges to deliver strong financial results that beat Wall Street estimates.

Financial Performance During the Quarter

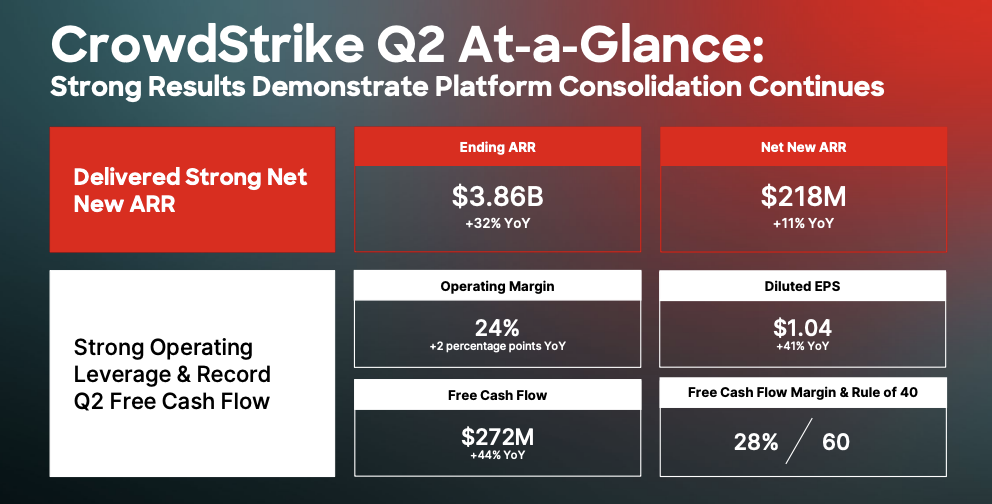

CrowdStrike’s Q2 financial results demonstrate strong performance despite the challenges posed by the July 19 incident.

- Annual Recurring Revenue (ARR):

- Ending ARR grew 32% year-over-year to $3.86 billion.

- Net new ARR of $218 million, up 11% year-over-year.

- Revenue:

- Total Q2 revenue reached $964 million, a 32% increase over the same quarter last year.

- Subscription revenue grew 33% year-over-year to $918.3 million.

- Profitability:

- Record non-GAAP operating income of $227 million, representing a 46% year-over-year increase.

- GAAP net income of $47 million, a more than fivefold increase over Q2 of the previous year.

- Free cash flow of $272 million, up 44% year-over-year, achieving a Rule of 60 on a free cash flow basis.

- Margins:

- Total gross margin was 78%, with a subscription gross margin of 81%, both reflecting improvements over the prior year.

Non-Financial Highlights

Beyond financial metrics, CrowdStrike made significant strides in product development and customer engagement.

- July 19 Incident Response:

- Immediate activation of CrowdStrike’s crisis response plan, focusing on transparency and recovery.

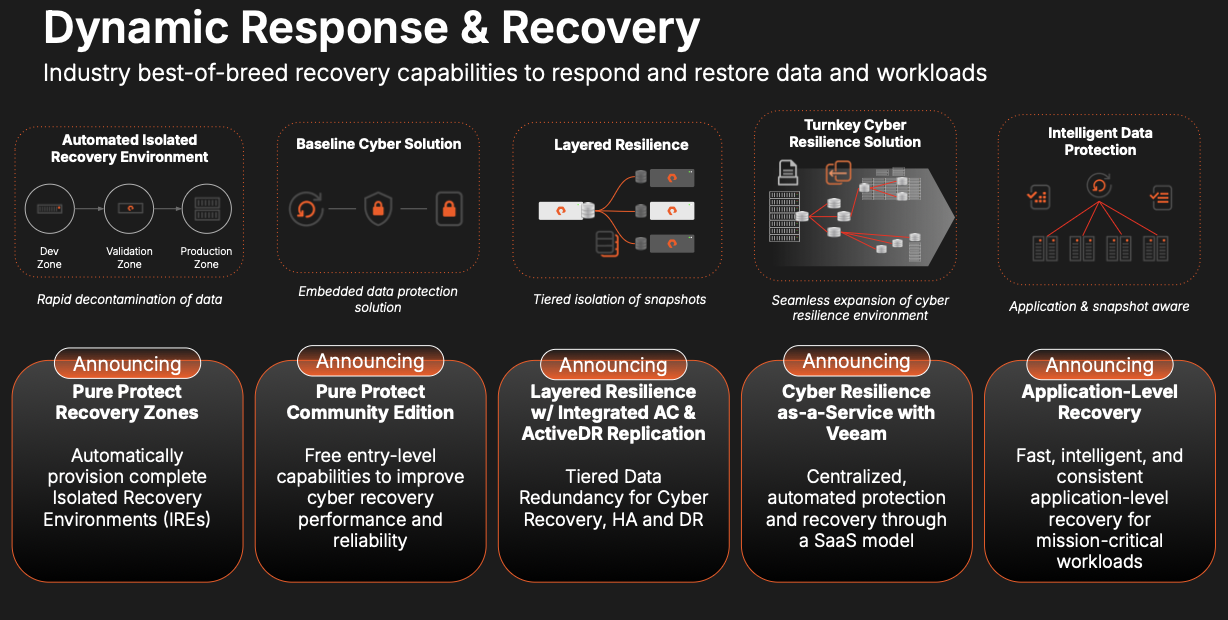

- New automated recovery techniques and content control configurations were deployed to enhance platform resilience.

- Introduction of external third-party reviews to validate the Falcon platform’s security and quality processes.

- Product and Platform Enhancements:

- Enhanced visibility and control for Falcon content, including granular control for customers over content deployment.

- Significant growth in LogScale Next-Gen SIEM, identity protection, and cloud security businesses, collectively surpassing $1 billion in ARR.

- Launch of new tools to further integrate AI and automation into cybersecurity operations.

- Customer Engagement:

- Strong customer feedback post-incident, with multiple 7- and 8-figure platform expansions, indicating continued trust in CrowdStrike’s solutions.

- Expansion of the Falcon Flex subscription program, which enhances platform adoption through flexible licensing and module access.

Guidance & Outlook

CrowdStrike’s management provided guidance for the upcoming quarters, reflecting cautious optimism in the wake of recent challenges.

- Q3 FY 2025 Guidance:

- Expected total revenue between $979.2 million and $984.7 million, representing a year-over-year growth rate of 25%.

- Non-GAAP income from operations forecasted to be between $166.7 million and $170.8 million.

- Non-GAAP net income per share expected to be between $0.80 and $0.81.

- Full FY 2025 Guidance:

- Total revenue for the year projected to be between $3.89 billion and $3.902 billion, a growth rate of 27% to 28%.

- Non-GAAP net income attributable to CrowdStrike expected to range from $908.8 million to $980 million.

- The company plans to shift some investment from sales and marketing to further R&D and customer support, reflecting a focus on long-term resilience and innovation.

Quick Take

The Q2 earnings reveal several key insights into CrowdStrike’s current position and future trajectory.

- Resilience Amidst Challenges:

- Despite the July 19 incident, CrowdStrike demonstrated strong operational resilience, quickly addressing the issue and continuing to grow its business.

- The rapid response and transparent communication likely mitigated longer-term damage to customer trust and retention.

- Continued Growth Potential:

- The growth in ARR and revenue, particularly in newer areas like cloud security and identity protection, suggests that CrowdStrike’s platform is well-positioned to capture expanding market opportunities.

- The Falcon Flex program and the strategic focus on platform consolidation are likely to drive further adoption and deeper customer engagement.

- Impact of the July 19 Incident:

- While the incident delayed some deals and introduced headwinds in the short term, the proactive measures taken by CrowdStrike should help to restore confidence and support future growth.

- The company’s investment in platform resilience and customer commitment packages indicates a strong focus on long-term customer loyalty and platform stickiness.

- Long-Term Outlook:

- The guidance reflects an expectation of ongoing challenges but also a belief in the company’s ability to rebound and accelerate growth in the latter half of FY 2025 and beyond.

- CrowdStrike’s continued innovation and expansion into adjacent markets, combined with its strong financial foundation, position it well for sustained success in the rapidly evolving cybersecurity landscape.

CrowdStrike’s Q2 earnings highlight the company’s ability to navigate challenges and reinforce its position as a leader in cybersecurity, with a clear strategy for future growth and resilience.