NetApp reported strong financial results for the first quarter of its fiscal year 2025. The company continues to demonstrate resilience and growth despite ongoing macroeconomic uncertainties, leveraging its innovative solutions in flash storage, cloud services, and AI to drive revenue growth and enhance market share.

Financial Performance During the Quarter

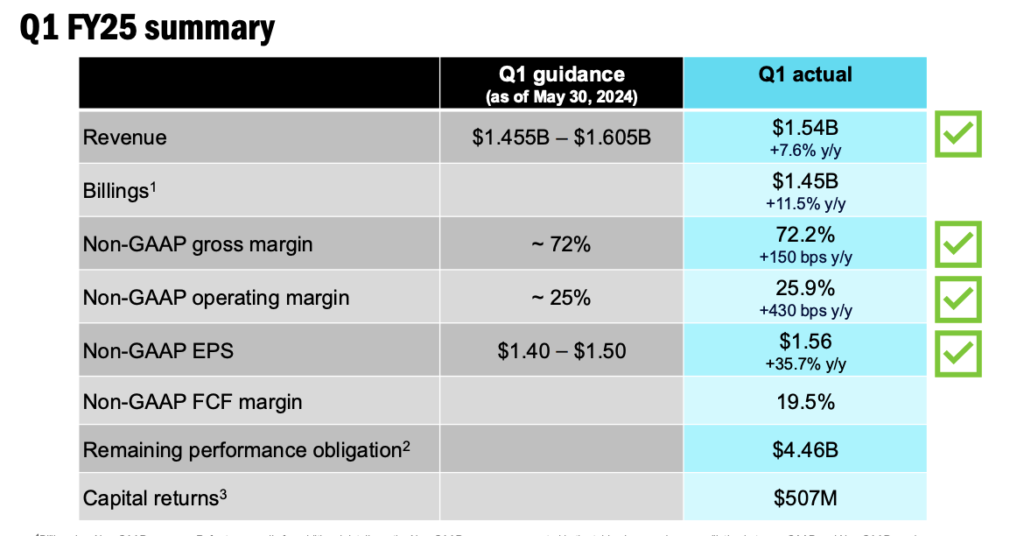

NetApp’s financial performance in Q1 FY ’25 reflected robust growth across key metrics:

- Revenue Growth: 8% year-over-year increase in revenue, totaling $1.54 billion.

- Operating Margin: Set a record for Q1 operating margin at 26%.

- Earnings Per Share (EPS): Achieved a record EPS of $1.56, exceeding expectations.

- Product Revenue: Increased by 13% year-over-year, driven by strong demand for all-flash storage solutions.

- Public Cloud Revenue: Grew by 3% year-over-year, with first-party and marketplace storage services growing by 40%.

- Cash Flow and Shareholder Returns: Operating cash flow was $341 million, with $507 million returned to shareholders through dividends and share repurchases.

Non-Financial Highlights

NetApp’s strategic initiatives and product innovations were key contributors to its Q1 success:

- All-Flash Storage Growth: The all-flash array (AFA) portfolio saw a 21% year-over-year increase in revenue, with strong customer adoption of the new AFFA Series.

- AI Infrastructure: NetApp secured over 50 AI-related wins, with significant projects in the oil and gas and financial services sectors.

- Keystone Storage-as-a-Service: Revenue from the Keystone offering grew by over 60% year over year, highlighting its appeal to customers with dynamic storage needs.

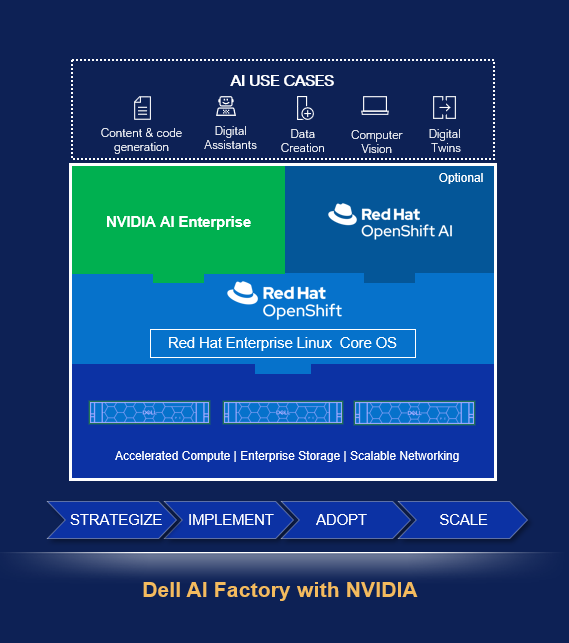

- Cloud Partnerships: NetApp strengthened its position in the cloud through partnerships with Lenovo, Microsoft Azure, and AWS, enhancing its capabilities for Gen AI workloads and hybrid cloud environments.

Guidance & Outlook

Building on its strong Q1 performance, NetApp has raised its financial outlook for FY ’25:

- Revenue Guidance: Full-year revenue is now expected to range between $6.48 billion and $6.68 billion, representing a 5% year-over-year growth at the midpoint.

- Operating Margin: Expected to remain strong at 27%-28%.

- EPS Guidance: Anticipated to be $7.00 to $7.20, reflecting a 10% year-over-year increase at the midpoint.

- Second Quarter Expectations: Q2 revenue is projected to be between $1.55 billion and $1.715 billion, with an EPS range of $1.73 to $1.83.

Quick Take

NetApp’s Q1 FY ’25 earnings are a solid start to its new fiscal year, driven by strategic focus and disciplined execution:

- Strategic Positioning: NetApp’s emphasis on AI, hybrid cloud, and flash storage positions it well in growing markets, helping the company outperform in a challenging macro environment.

- Innovation and Execution: The successful launch and adoption of new products, particularly in the all-flash array segment, show that NetApp maintains its ability to innovate and meet evolving customer needs.

- Resilience Amid Uncertainty: Despite geopolitical and economic challenges, NetApp’s diverse product portfolio and strong customer relationships are likely to continue driving solid financial performance throughout FY ’25.

Its earnings report suggests that NetApp is well-positioned to capitalize on industry trends, making it a company to watch for continued growth and innovation in the technology sector.