Nutanix reported its Q4 FY 2024 earnings, showing strong financial performance and strategic advancements and beating Wall Street estimates for both revenue and earnings. The company exceeded its financial targets, showcased innovation, and deepened partnerships, positioning itself as a critical player in the hybrid multi-cloud space.

Financial Performance During the Quarter

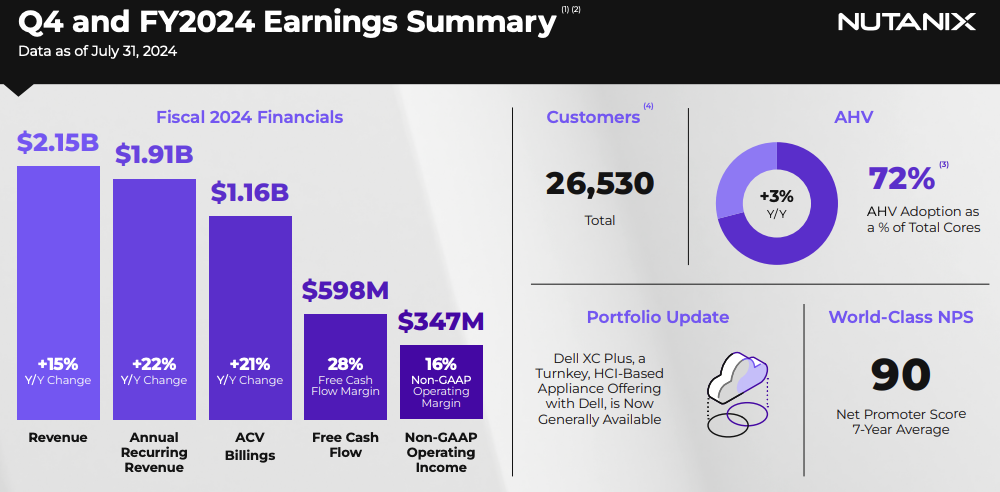

Nutanix’s financial performance in Q4 FY 2024 was marked by solid revenue growth, strong cash flow generation, and exceeding all guided metrics.

- Revenue:

- $548 million, up 11% year-over-year (YoY).

- Growth driven by strong demand for Nutanix’s hybrid multi-cloud solutions.

- Free Cash Flow:

- $224 million in Q4, representing a free cash flow margin of 41%.

- Full-year free cash flow reached $598 million, nearly tripling YoY.

- Annual Recurring Revenue (ARR):

- Ended Q4 at $1.91 billion, a 22% increase YoY.

- Operating Metrics:

- Non-GAAP gross margin at 86.9%, above the guided range.

- Non-GAAP operating margin at 12.9%, surpassing the guided range due to lower operating expenses and higher gross margin.

Non-Financial Highlights

Beyond its financial achievements, Nutanix made significant strategic advancements in product development and partnerships.

- Product Innovations:

- Launched GPT-in-a-Box to streamline the adoption of generative AI by enterprises.

- Introduced Nutanix Data Services for Kubernetes (NDK) and Nutanix Kubernetes Platform (NKP) to enhance the management of modern applications across cloud environments.

- Partnerships:

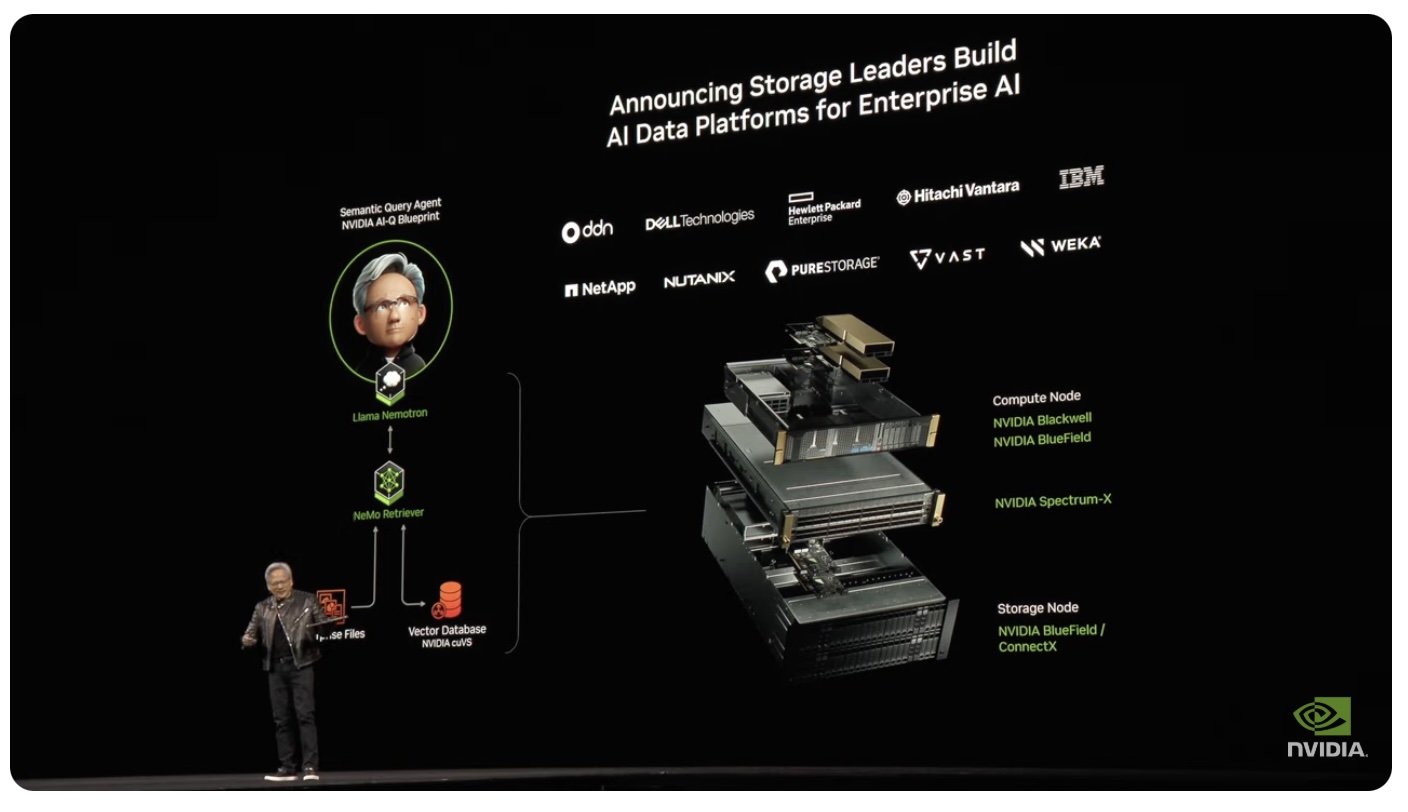

- Strengthened alliances with Cisco, Dell, and NVIDIA, enhancing market reach and go-to-market leverage.

- Dell XC Plus: A new turnkey HCI-based appliance, expanding Nutanix’s hardware offerings.

- Customer Wins:

- Secured significant deals, including a multimillion-dollar ACV deal with a North American Fortune 100 financial services company.

- Expanded presence in Europe and Asia with key wins in the semiconductor and research services sectors.

Guidance & Outlook

Nutanix provided optimistic guidance for FY 2025, indicating confidence in its market position and future growth.

- Revenue Guidance:

- Expected between $2.435 billion and $2.465 billion, representing 14% YoY growth at the midpoint.

- Operating Margin:

- Non-GAAP operating margin projected between 15.5% and 17%.

- Free Cash Flow:

- Forecasted between $540 million and $600 million, with a free cash flow margin of approximately 23% at the midpoint.

- Strategic Focus:

- Continued focus on expanding its presence in the high-value enterprise market.

- Ongoing investments in R&D and sales & marketing to capture market share and drive long-term profitability.

Analysis of the Earnings and the Impact on Nutanix’s Business

Nutanix is firing on all cylinders, exceeding all estimates. Some of this success continues to come because of the disruption caused by Broadcom’s VMware acquisition, but much more of it is simply the result of combined strength of its offerings with an expanded set of partners.

Nutanix has also grown its market reach of the past several quarters with new strategic relationships with Cisco, Dell, and NVIDIA. Dell’s is the most notable, but each of these partners are starting to sell more bundled Nutanix solutions. This has a growing impact on Nutanix’s revenue and will only increase over the coming quarters.

Like Pure Storage, Nutanix also noted longer than expected sales cycles. Some of this comes from both companies growing into larger and more complex enterprise deals, where risk tolerance is lower and evaluation times longer. It’s a good problem to have and should only impact short-term revenue, not long-term success. Nutanix has the right product mix.

Nutanix’s strong financial and operational performance positions it favorably against competitors like VMware, especially as enterprises increasingly adopt hybrid multi-cloud solutions.

Nutanix’s Q4 FY 2024 earnings show a company in a strong position to capitalize on the growing demand for hybrid multi-cloud solutions, supported by robust financial performance, strategic innovation, and deepening partnerships.