Oracle’s fiscal Q1 2025 results beat Wall Street expectations, reporting $13.3 billion in total revenue, an 8% increase year-over-year. More impressively, its cloud revenue surged 22%, hitting $5.6 billion, a key driver of its overall growth. Oracle’s multi-cloud strategy, coupled with cutting-edge AI capabilities, has expanded its market reach and enhanced its profitability.

Let’s take a look at what Oracle’s earnings release revealed.

Financial Performance

Oracle had solid financial growth during Q1, surpassing its own guidance expectations and showing strong revenue gains across its cloud services and infrastructure offerings.

- Total Revenue: $13.3 billion, up 8% year-over-year.

- Cloud Revenue:

- Total cloud revenue (SaaS and IaaS) up 22% to $5.6 billion.

- SaaS revenue: $3.5 billion, up 10%.

- IaaS revenue: $2.2 billion, up 46%.

- Cloud Services and License Support: $10.5 billion, up 11%.

- Application Subscription Revenues: $4.8 billion, up 7%.

- Infrastructure Cloud Services: Annualized revenue of $8.6 billion, up 46%.

- Operating Margins:

- Operating income grew by 14%, with an operating margin of 43%.

- Gross margins for both cloud applications and infrastructure increased.

- Earnings Per Share (EPS):

- Non-GAAP EPS: $1.39, up 17%.

- GAAP EPS: $1.03, up 20%.

- CapEx: $2.3 billion, with expectations for FY 2025 CapEx to double FY 2024 levels.

Non-Fiscal Highlights

In addition to its financial performance, Oracle highlighted several key non-financial announcements during its earnings call that reflect its strategic direction and focus on technological advancements:

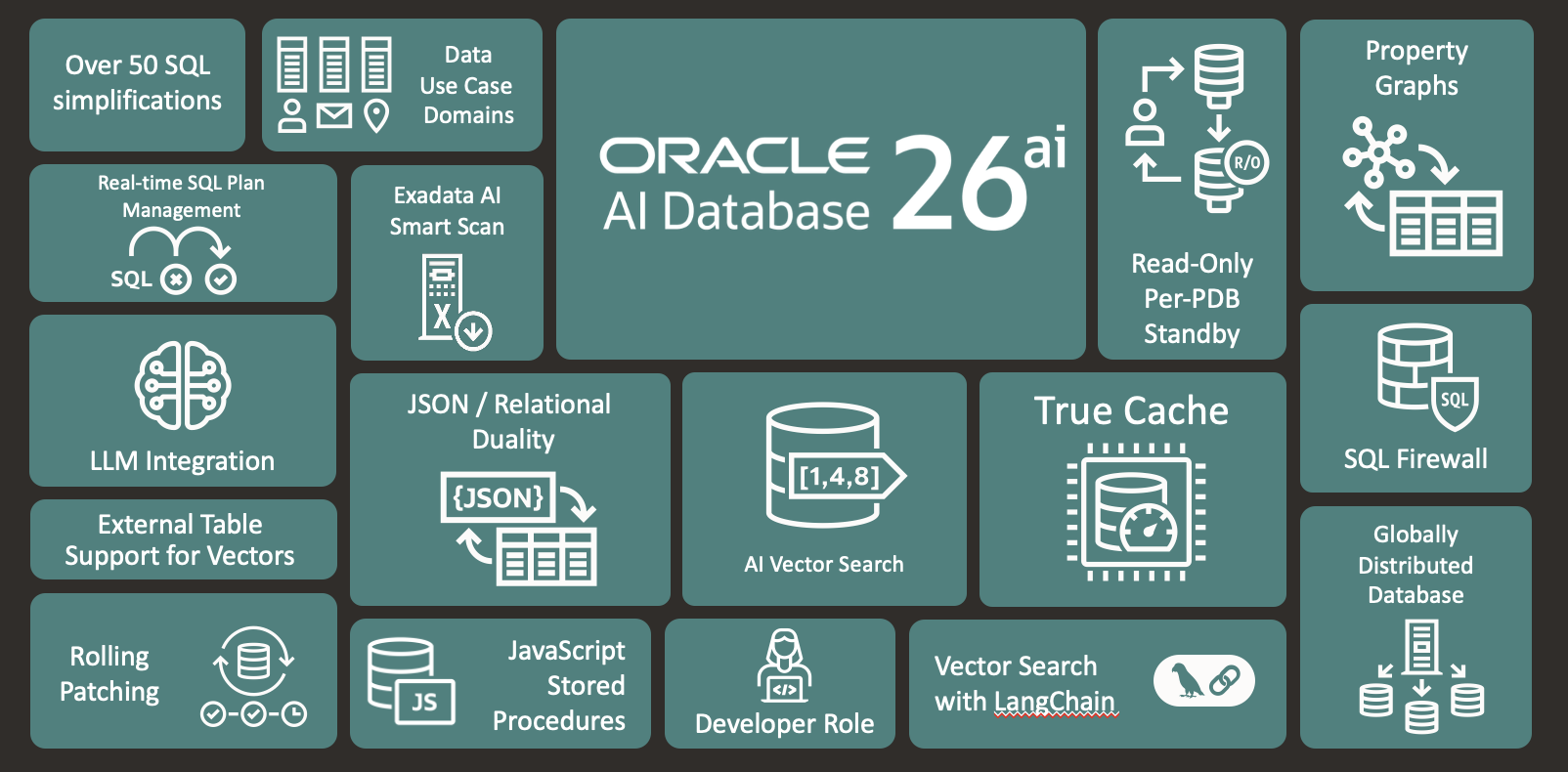

- Cloud World in Las Vegas: Oracle unveiled new features across OCI, databases, analytics, and its industry-specific applications, including embedded AI agents to boost productivity.

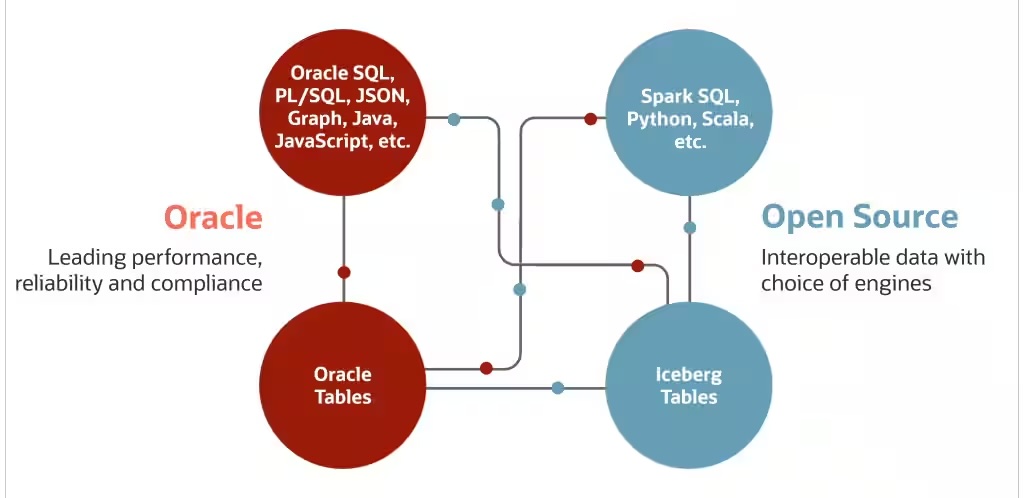

- Multi-cloud Partnerships: Expanded cloud partnerships with AWS, Microsoft Azure, and Google Cloud, enhancing Oracle Cloud Infrastructure (OCI) availability across these platforms.

- Cloud Regions: Oracle operates 85 cloud regions, with 77 more planned. This includes public cloud regions, dedicated cloud customer regions, national security regions, and multi-cloud regions.

- Expansion of Autonomous Database: This is a key growth area, with Oracle moving more applications like Fusion and NetSuite to its Autonomous Database to improve efficiency and security.

Guidance & Outlook

Oracle offered optimistic guidance for the upcoming quarter and fiscal year, expressing its confidence in continued growth, especially in cloud and database services:

- Q2 Revenue Growth:

- Expected total revenue growth between 8% and 10%.

- Cloud revenue is expected to grow between 24% and 26%.

- EPS Guidance:

- Non-GAAP EPS is projected to be between $1.45 and $1.49.

- FY 2025 Outlook:

- Double-digit total revenue growth is expected for the full year.

- Faster cloud infrastructure revenue growth compared to the prior year.

Deep Dive: Impact of Cloud

Oracle’s cloud business significantly impacted its Q1 earnings, contributing to both revenue growth and profitability.

Here’s a breakdown of its influence:

- Revenue Growth: Oracle’s cloud business, which includes both SaaS (Software as a Service) and IaaS (Infrastructure as a Service), was a major driver of overall revenue growth. Cloud revenue grew by 22% year-over-year, reaching $5.6 billion. This growth was supported by:

- SaaS revenue increased 10%, reaching $3.5 billion.

- IaaS revenue surged 46% to $2.2 billion, reflecting strong demand for OCI.

- Improved Margins: The scalability of Oracle’s cloud services, particularly its infrastructure offerings, improved gross margins. The cloud business benefits from increased automation and lower operational costs, particularly through the use of Oracle’s Autonomous Database. This drove margin expansion despite the lower margins typically associated with cloud infrastructure services.

- OCI Demand: Oracle Cloud Infrastructure saw significant demand, with OCI consumption revenue up 56%. This outpaced supply, highlighting the business’s potential for continued future growth.

- Cloud as a Growth Engine: Oracle’s multi-cloud strategy, which includes partnerships with major cloud providers like AWS, Microsoft Azure, and Google Cloud, expanded the accessibility and adoption of Oracle’s cloud products, positioning it as a third leg of growth alongside its database and strategic SaaS offerings.

- Contribution to Long-Term Contracts: Oracle’s cloud-related remaining performance obligations (RPO) grew over 52%, driven by larger and longer-term contracts. The cloud business now represents nearly three-quarters of total RPO, demonstrating its central role in Oracle’s future revenue stream.

Analysis

Oracle’s Q1 earnings are a direct result of its strong (and growing) position in the cloud market and its strategic focus on innovation and automation. Its multi-cloud strategy and partnerships with major cloud providers demonstrate Oracle’s adaptability and long-term growth potential.

- Strength in Cloud Services: The substantial growth in IaaS revenue (46%) and overall cloud services highlights Oracle’s successful shift towards cloud computing and infrastructure, competing effectively with industry leaders.

- Scalability and Automation: Oracle’s ongoing emphasis on automation, especially with the Autonomous Database, enhances its security, efficiency, and ability to scale cloud operations.

- Margin Improvement: The company managed to grow its cloud services while improving operating margins, demonstrating the scalability and profitability of its cloud offerings.

- Multi-cloud Strategy: By partnering with AWS, Microsoft, and Google, Oracle is increasing its cloud footprint, which will likely drive sustained growth, particularly in its database and cloud infrastructure business.

- Capital Investments: Oracle’s planned doubling of CapEx in FY 2025 signals its intent to meet rising demand for its cloud services and ensure future capacity and performance improvements.

The integration of AI into enterprise applications also added value on the customer side, automating workflows and improving decision-making processes for clients. This is a competitive advantage for Oracle, particularly in industries looking to modernize and streamline operations. The fact that Oracle is embedding AI in its infrastructure and applications shows that it is not only keeping pace with but also outpacing many of its competitors when it comes to enterprise AI.

Oracle remains strongly positioned to capitalize on the cloud and AI megatrends, which are reshaping the enterprise software landscape. The company’s ability to combine AI automation with a multi-cloud strategy drives top-line growth and margin expansion. Looking ahead, Oracle’s aggressive investment in cloud infrastructure and efficiency gains from AI-driven automation point to sustained growth and profitability in the coming quarters.