VMware recently revealed changes in how VMware products will be licensed and sold, consolidating offerings into two basic bundles.

Shortly after announcing the new bundles, the company said that it would also be reducing the subscription price of VMware Cloud Foundation (VCF) “by half,” surprising many industry analysts and customers, as Broadcom had previously indicated plans to nearly double VMware’s profitability within three years of closing the acquisition.

While the price reductions may seem positive on the surface, there are significant questions as to whether IT buyers are actually saving money, especially as clarity emerges on the details of VMware’s new bundling scheme and the operational limits it’s now placing on products like vSAN.

Many existing VMware customers will likely be surprised by the changes and should look carefully at the overall impact. Let’s first look at the details of VMware’s new bundles and pricing, then delve into a few examples of how this may impact current VMware customers.

VMware Bundles

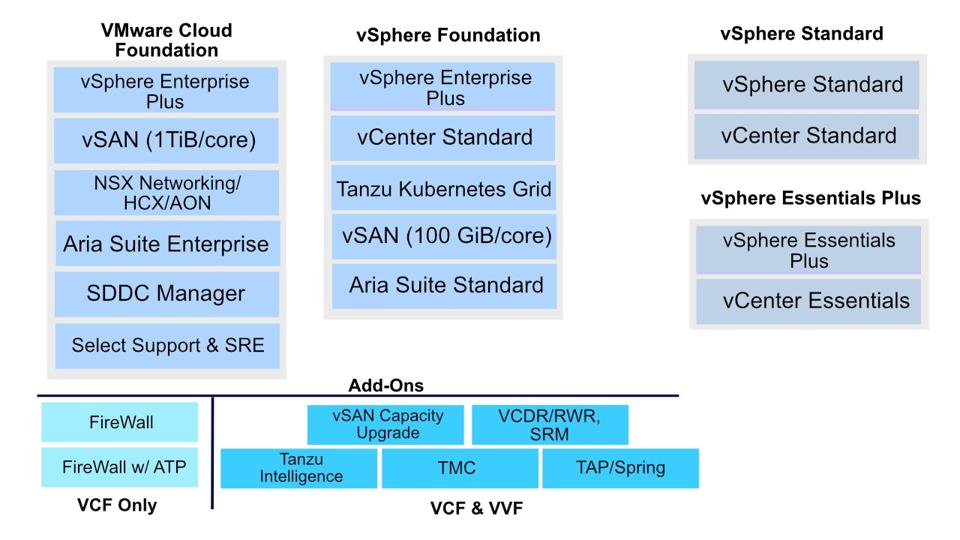

VMware is consolidating current products into two primary offerings: vSphere Foundation (VVF) and VMware Cloud Foundation (VCF). At the same time, VMware will stop selling individual products outside of these bundles. Popular products like Aria Suite, NSX Networking, and vSAN can now only be purchased as part of a bundle.

As part of its new bundling, VMware introduced VMware vSphere Foundation. VVF is a more modest offering bundle for mid-sized and smaller customers who may not need the full range of products available in VCF.

VMware also offers entry-level customers basic vSphere Standard and vSphere Essentials Plus packages. These packages do not support any add-ons, with customers being required to upgrade to VCF or VVF for additional functionality.

Pricing Revealed

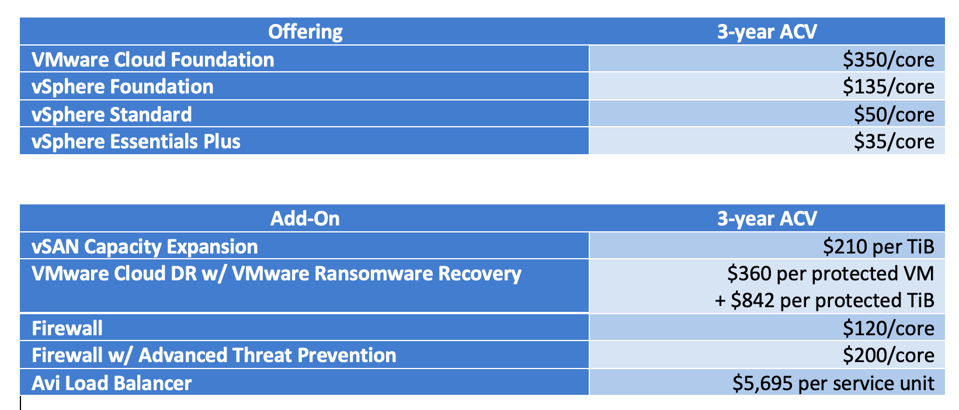

VMware announced a 50% price reduction for VMware Cloud Foundation as part of its new pricing plan for VCF. Even with reduced pricing, however, the new bundles will likely increase overall costs for many existing VMware vSphere customers.

This week, the company shared its new pricing with customers and analysts. The following illustration shows the list price for a 3-year average contract pricing for the new offers, though most enterprise customers, in practice, will pay a discounted rate.

Impact on IT Buyers

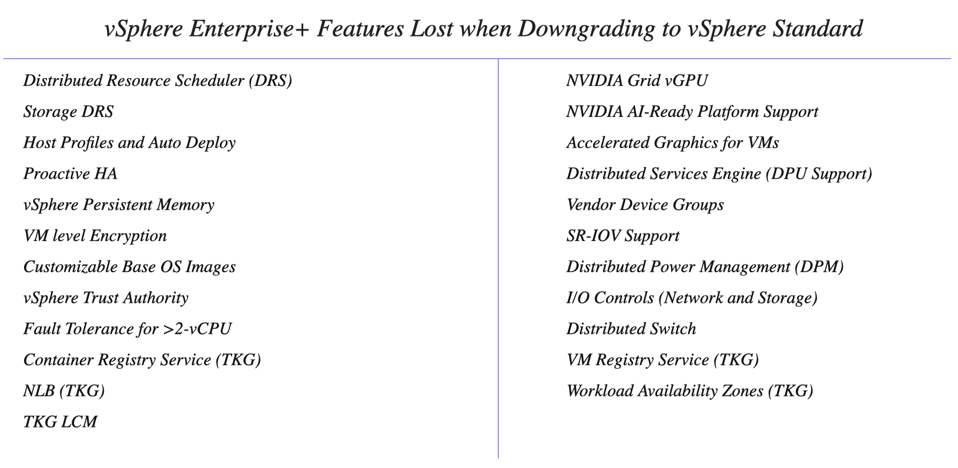

The impact of the changes is perhaps most significant for existing vSphere Enterprise customers who must now upgrade to the new VVF or VCF bundles. Those customers will find that some functionality previously included in their subscriptions is currently only available as an add-on, resulting in costs that exceed the new bundle pricing.

At the same time, downgrading from vSphere Enterprise+ to vSphere Standard isn’t a viable option, as those customers would lose significant functionality.

VMware vSAN customers are also in for some surprises. Beyond paying for unneeded bundled features, the new capacity-based pricing will force a capacity upgrade entitlement for many (if not most) vSAN customers.

At the same time, many vSAN installations only use a subset of the functionality delivered in the new VVF and VCF bundles, causing those customers to pay a premium over previously stand-alone vSAN offerings to purchase additional software that will go unused.

These are just a few examples of the impacts that IT buyers should be aware of. For a more in-depth look, the reader is referred to a recently published Research Brief that looks at the potential impacts existing VMware customers might run into. VMware competitor Nutanix also recently published a blog post that looks at potential effects. Both are worth reading.

Analysis

VMware’s moves come just weeks after Broadcom closed its acquisition of the company. In those few weeks, VMware has dramatically altered its licensing, signaled the layoffs of nearly 3,000 employees, and vacillated on whether it’s divesting its desktop and Carbon Black businesses. All of this creates significant uncertainty.

As in any period of uncertainty involving critical technologies, we advise that IT organizations take a comprehensive look at both the costs and risks before committing to any significant VMware deployment or renewing long-term license agreements.

Whenever feasible, IT buyers should look to mitigate risks with a dual-vendor approach. Many VMware customers across the board are already adopting alternative or dual-sourced solutions where possible while looking at alternative solutions for greenfield projects. There are robust offerings from VMware competitors, such as Nutanix and Scale Computing.

As the industry watches, Broadcom’s stewardship of VMware over the coming fiscal year will be a critical test of its strategic vision for enterprise software dominance. While Broadcom is clearly focused on getting the financial aspects of the acquisition quickly under control, how the company will deliver long-term value to its VMware customers remains unclear.

Until there’s clarity, however, IT organizations should continue to act cautiously as they manage the risk and uncertainty of Broadcom’s continuing integration (and divestiture) of VMware’s people, products, and services. The significant changes within VMware in its first few weeks as a Broadcom asset are telling, and further shifts are likely to unfurl as Broadcom focuses on its publicly stated profitability goals.