All of the major public cloud providers have released earnings for calendar Q3 2024, allowing us to draw conclusions about the state of the public cloud market and the relative competitiveness of each CSP. The public cloud market remains highly competitive and rapidly evolving, with each provider strategically leveraging AI, infrastructure innovation, and multi-cloud partnerships to drive growth.

Let’s look at how each CSP performed during the quarter.

Amazon AWS

Amazon’s AWS segment saw significant growth and strong market positioning during the quarter, with several key points underscoring its performance and strategic direction:

- Revenue Growth and Market Position: AWS achieved 19.1% year-over-year growth, reaching a $110 billion annualized run rate. This reacceleration in growth over the past four quarters highlights AWS’s continued strength and competitive position as the dominant cloud provider.

- AI and Generative AI Offerings: AWS’s AI business is rapidly expanding, with a multibillion-dollar revenue run rate and triple-digit year-over-year growth. This growth is fueled by AWS’s extensive array of machine learning and generative AI features, released at what Amazon claims is nearly double the pace of other cloud providers. AWS focuses on three layers of AI capabilities: foundational model-building infrastructure (using NVIDIA GPUs and its custom silicon, Trainium and Inferentia), middle-layer services like Amazon Bedrock, which supports a broad range of foundation models, and application-level solutions such as Amazon Q, a generative AI-powered software development assistant.

- Strategic Partnerships and Infrastructure Enhancements: In its earnings conference call, AWS highlighted partnerships such as Project Ceiba with NVIDIA and innovations like the Graviton4 CPU and Aurora database.

- Operational Efficiency and Profitability: AWS’s operating income rose by $3.5 billion year-over-year to $10.4 billion, driven by cost controls, infrastructure efficiency, and reduced hiring. Adjustments in server useful life estimates also contributed to increased margins, while AWS’s focus on measured investment sustains profitability amidst continued expansion.

- Investment in Technology Infrastructure: AWS is heavily investing in technology infrastructure, with Amazon forecasting approximately $75 billion in 2024 capital expenditures, primarily to support its growing cloud and AI services demand.

Google Cloud

Google Cloud reported strong performance and strategic advancement during the quarter, driven by its AI and infrastructure capabilities.

Key takeaways include:

- Revenue and Growth: Google Cloud reported $11.4 billion in Q3 revenue, a 35% year-over-year increase. Operating margins rose to 17%, with Google Cloud Platform (GCP) growth outpacing the overall cloud segment. This is the strongest revenue growth for GCP in recent memory.

- AI Infrastructure and Services: Google’s cloud business is strengthened by its AI infrastructure, which includes high-performance TPUs (now in their sixth generation) and advanced data processing. Google Cloud’s Vertex AI platform is increasingly adopted for building and customizing foundation models, with Google reporting 14x growth in Gemini API calls.

- Integration of AI with Data and Security: Google Cloud’s synergy between AI and data services is a key differentiator, with BigQuery enabling real-time decision-making for customers like Hiscox. Cybersecurity is also a focus, with Google’s Mandiant-powered threat detection gaining adoption for faster threat response. This alignment supports Google’s broader push for AI-driven cloud adoption in business-critical areas.

- Strategic Investments and Cost Efficiency: Google continues to invest in AI and cloud infrastructure globally, with planned data center investments exceeding $7 billion in Q3 alone. Ongoing initiatives to optimize headcount and infrastructure efficiency further support profitability while allowing for strategic investment in growth areas.

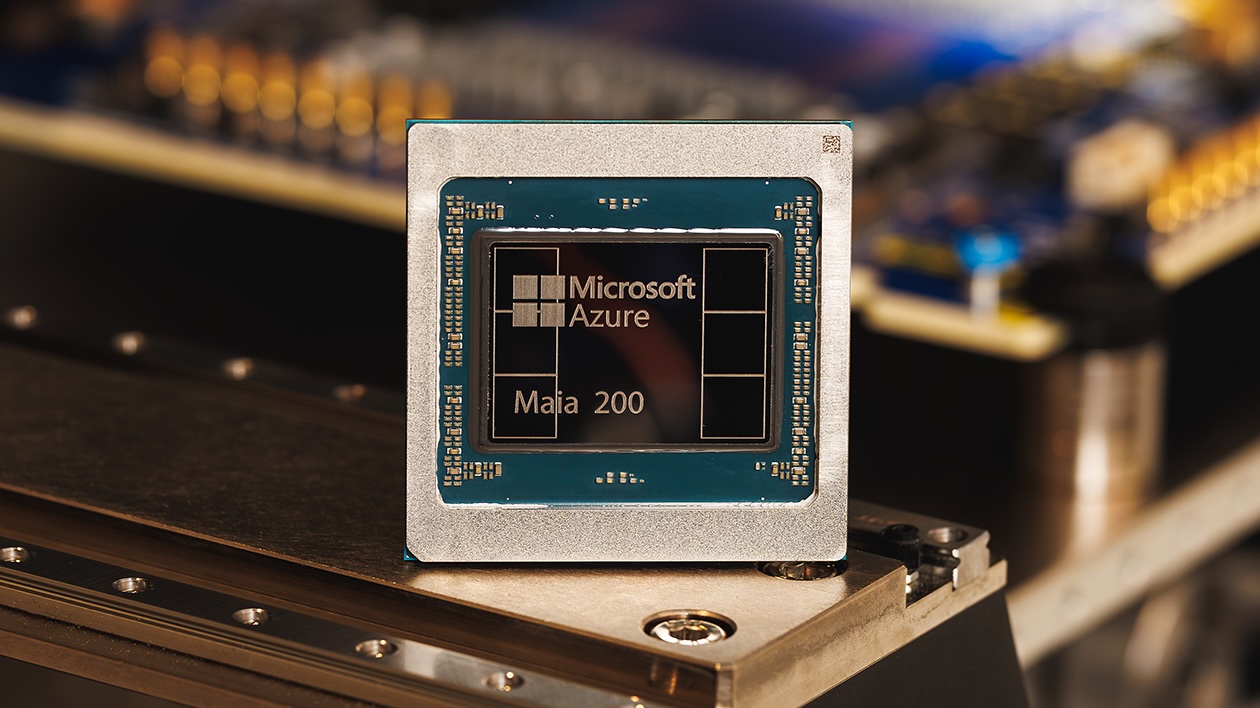

Microsoft Azure

Microsoft’s cloud business, which includes Azure and other offerings like Microsoft Dynamics 365, saw robust growth and is a core driver of the company’s financial performance.

Here are some key highlights for the most recent quarter:

- Revenue Growth: Microsoft’s overall cloud business reached $38.9 billion in revenue, a 22% increase year over year. Azure grew by 33%, driven by AI services and broader cloud adoption.

- AI Transformation and Revenue: AI-driven products are central to Microsoft’s cloud strategy. AI business revenue is on track to surpass a $10 billion annual revenue run rate, marking the fastest business growth in the company’s history.

- Azure Expansion and Partnerships: Azure saw growth in migration and expanded its footprint with over 60 global data centers, including recent investments in Brazil, Italy, Mexico, and Sweden.

- Operational and Financial Discipline: Despite substantial investments in cloud and AI infrastructure, Microsoft maintained disciplined cost management, helping achieve a 47% operating margin.

Oracle OCI

Oracle’s Oracle Cloud Infrastructure (OCI) business continues to experience significant growth and strategic positioning, particularly in multi-cloud partnerships, AI infrastructure, and database offerings.

Here are the key points:

- Strong Growth in Cloud Revenues: Oracle reported 22% year-over-year growth in its cloud services, with total cloud revenue reaching $5.6 billion. Infrastructure-as-a-Service (IaaS) grew by 46%. Oracle’s cloud RPO growth of over 80% shows strong customer demand, and the company expects cloud revenue growth to continue accelerating in fiscal 2025.

- Expansion of Multi-Cloud Partnerships: Oracle’s partnership with AWS joins its existing collaborations with Microsoft Azure and Google Cloud, allowing Oracle Database to operate across multiple major cloud platforms. Its multi-cloud strategy makes OCI and Oracle Database more accessible and popular, leveraging the strengths of each cloud provider to attract shared enterprise customers.

- Investment in AI and Advanced Infrastructure: Oracle continues expanding its data center footprint, with 85 cloud regions live and 77 more planned. The company is building massive GPU clusters with NVIDIA technology, positioning OCI to support AI and machine learning workloads at scale.

- Oracle Database as a Growth Driver: Oracle’s database business is thriving as it integrates with OCI and expands to other cloud platforms. Migrating on-premises Oracle databases to cloud environments on OCI or other platforms is expected to form a “third leg” of revenue growth alongside OCI and SaaS.

- Commitment to Financial Discipline and Shareholder Value: Oracle demonstrated financial discipline with a 14% increase in operating income and strong operating margins. The company also projects to double its fiscal 2025 CapEx to keep pace with demand, emphasizing OCI’s role in Oracle’s long-term growth strategy.

Analysis

The earnings releases for each of the CSPs highlight several key trends and dynamics within the public cloud market:

- AI is a Central Growth Driver: Across all four cloud providers, AI and machine learning capabilities are central to growth, catering to demand for advanced data analytics, generative AI, and real-time decision-making. Each CSPs are heavily investing in AI infrastructure, including custom silicon and specialized accelerators, to meet customer demand for efficient and scalable AI workloads.

- Multi-Cloud Strategies for Flexibility and Reach: The emergence of multi-cloud partnerships (particularly Oracle’s partnerships with AWS, Microsoft, and Google Cloud) mirrors the broader industry trend toward cloud interoperability. Enterprises are demanding this flexibility to choose best-of-breed solutions across providers.

- Industry-Specific Solutions: Tailored cloud solutions for industries such as finance, automotive, and healthcare are increasingly shaping cloud adoption, with providers integrating AI and machine learning to create specific value. Offerings like Google’s Customer Engagement Suite and Microsoft’s Dynamics 365 are driving vertical-specific adoption by addressing unique industry needs.

- Continued Infrastructure Expansion: The cloud giants invest heavily in expanding data center regions and advanced networking capabilities to support global demand. This expansion allows them to meet local compliance requirements and improve service proximity, especially for latency-sensitive and data-heavy applications.

Google’s growth is particularly notable. GCP has always seen lagging growth relative to its competitors, but that’s changing. Much of GCP’s surge is related to its investments in AI, but the solution overall is proving remarkably strong, with enterprise customers taking note.

Overall, the public cloud market remains dynamic, with AWS, Google Cloud, Microsoft Azure, and Oracle OCI each carving unique positions through AI innovation, multi-cloud flexibility, industry-specific solutions, and infrastructure growth. There’s never been a better time to be a cloud customer.