A version of this blog post first appeared Here on Forbes.

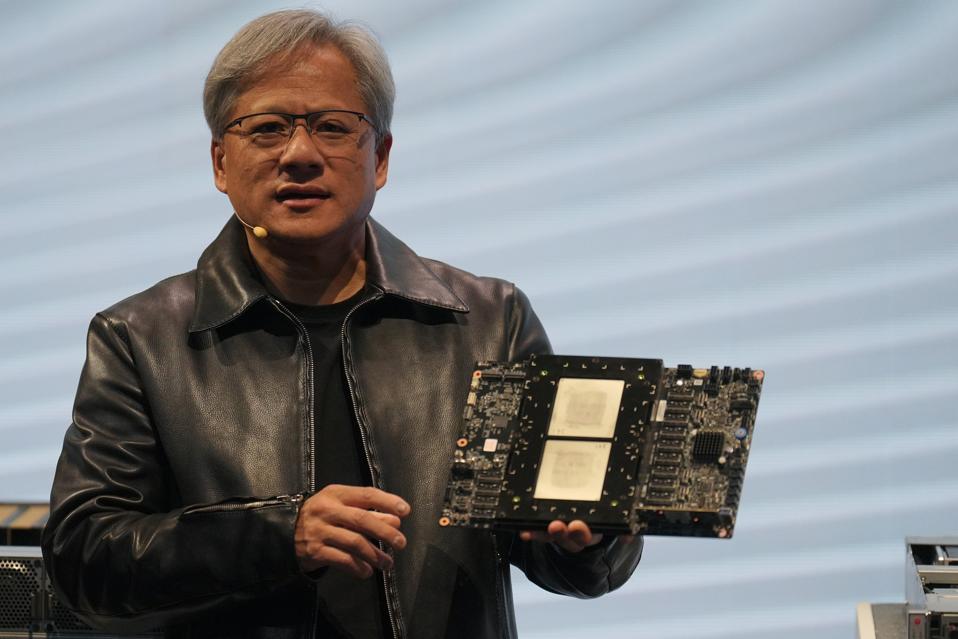

Nvidia’s most recent earnings release is a tremendous achievement for the company, with reported revenue of $22.1 billion, up an incredible 265% year-on-year. Earnings grew an equally unbelievable 765% year-on-year.

While its data center business garners the most attention, Nvidia breaks its business into four strategic markets: data center, gaming, professional visualization, and automotive. Gaming and professional visualization are Nvidia’s legacy, while data center and automotive are its future.

Nvidia estimates that the size of the autonomous machine market, which includes automotive, is a $300 billion opportunity over the long term, exactly matching what the company believes its data center market opportunity to be. Market analysts believe that the combined value of automotive ADAS and infotainment systems will exceed $100 billion by 2030.

In its earnings for fiscal Q4, Nvidia reported data center revenue of $18.4 billion. Its automotive revenue was $281 million.

In-Vehicle Compute

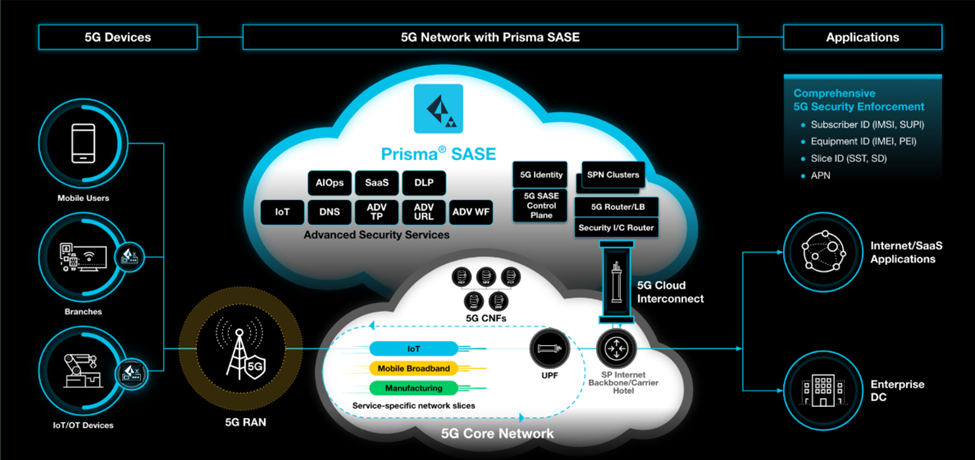

There’s an industry-wide shift in automotive from the traditional array of small dedicated embedded computers within an auto towards a more centralized “zonal” architecture that consolidates its compute capabilities. While there are many reasons behind the zonal approach, the trend towards assisted and autonomous driving is high on that list.

Nvidia is a natural to compete in the emerging ADAS market (think of ADAS, or the advanced driver assistance system, as the brain of modern automobiles), where advanced AI capabilities are required to manage the increasing number of sensors needed for most levels of assisted driving. Beyond ADAS, Nvidia’s legacy in gaming and media equips the company with a solid foundation upon which to build a business supplying automotive infotainment and digital cockpit solutions.

Nvidia services the in-vehicle compute market with its Nvidia Drive offerings. This includes a set of software and silicon tools deployed within a vehicle. It also consists of a data center component for developing autonomous driving features.

While automotive is a solid business for Nvidia, generating just over $1 billion in revenue during fiscal 2024, it’s unclear that the company is keeping pace with the overall market. During its fiscal Q4, Nvidia generated just $281 million in automotive revenue, falling 4% year-on-year–a very different picture from its AI-driven business.

Competitive Environment

The move to zonal architecture has cars looking more like a data center than a traditional automobile. Bringing together the evolving ADAS market with the expansion of conventional infotainment systems into more broadly integrated digital cockpits is a natural market for traditional technology companies to compete; many are, including Qualcomm, Intel, and AMD.

Qualcomm, which has a long history of providing connectivity solutions for the automotive industry, is Nvidia’s most directly comparable competitor in this segment.

Qualcomm’s Snapdragon Digital Cockpit platform, which includes Qualcomm’s Snapdragon Ride Flex SoC, is the company’s play for in-vehicle computing, including the ADAS and infotainment markets. Qualcomm has an intrinsic advantage over Nvidia in this market, as Qualcomm has long led the way in providing connectivity solutions to the automotive industry.

It’s also worth noting that while advanced driving systems rely on AI inference, this isn’t a market that requires data center class accelerators. It’s also not a market that relies on Nvidia’s CUDA software stack, offering a lower competitive barrier to entry. Qualcomm’s inference accelerators excel at delivering AI inference, outperforming Nvidia in power efficiency–a critical capability in an automobile.

There’s been a solid market response to Qualcomm’s automotive play. In its latest earnings, the company reported automotive revenue, including connectivity, grew 31% year-on-year to $598M. While connectivity undoubtedly provides some of that revenue, its solutions seem to be better received by the market.

Of course, incumbent auto electronics manufacturers aren’t going to cede the market to new competitors easily. Some of these providers, such as Visteon and Bosch, are partnering with companies like Qualcomm and Nvidia.

Processor vendors Intel and AMD are also targeting solutions for the segment. Intel announced new automotive-target SoCs at CES earlier this year, while AMD previewed a new solution that combines its processor and FPGA technologies. These are compelling building blocks for subsystem suppliers but are less comprehensive than Nvidia and Qualcomm’s solutions.

Analysis

Nvidia’s strength in automotive is balanced by the increased competitiveness of the space, where it doesn’t have the dominance or lock-in it enjoys in the broader data center market. Qualcomm is growing its automotive business faster than Nvidia. Component-focused companies, like Intel and AMD, are primed to enable a wide range of competitors for in-vehicle computing, including traditional auto subsystem vendors.

One bright spot for Nvidia in the segment is its near domination on the data center side of the automotive business, where its accelerators and professional graphics cards are used to design, train, and simulate autonomous driving systems.

Nvidia noted during its earnings call that automotive contributed more than $1 billion to its data center business in its past fiscal year. The company has nearly 80 vehicle manufacturers across global OEMs, new energy vehicles, trucking, robotaxi and Tier 1 suppliers using Nvidia’s AI infrastructure to train LLMs and other AI models for automated driving and AI cockpit applications. But that success doesn’t necessarily translate into in-vehicle design wins.

Nvidia doesn’t need to play in the automotive segment. While its AI data center business is unlikely to maintain its current growth rate and high margins over the long term, it will remain a significant market where Nvidia is the incumbent. There’s enough business in that space to satisfy most technology companies.

At the same time, Nvidia believes that the in-vehicle automotive space has a long-term value equal to that of its data center business. In-vehicle automotive is a natural expansion for Nvidia, one that the company treats as strategic, even if its growth and revenue don’t yet reflect the same success its competitors are enjoying.

It’s been a long time since Nvidia faced a market as competitive as in-vehicle automotive or where it arrived without all the needed pieces (such as connectivity). This will continue to be a challenging journey for Nvidia, but the payoff can ultimately be as significant as the success it sees in data center AI. It’s a story worth watching unfold.