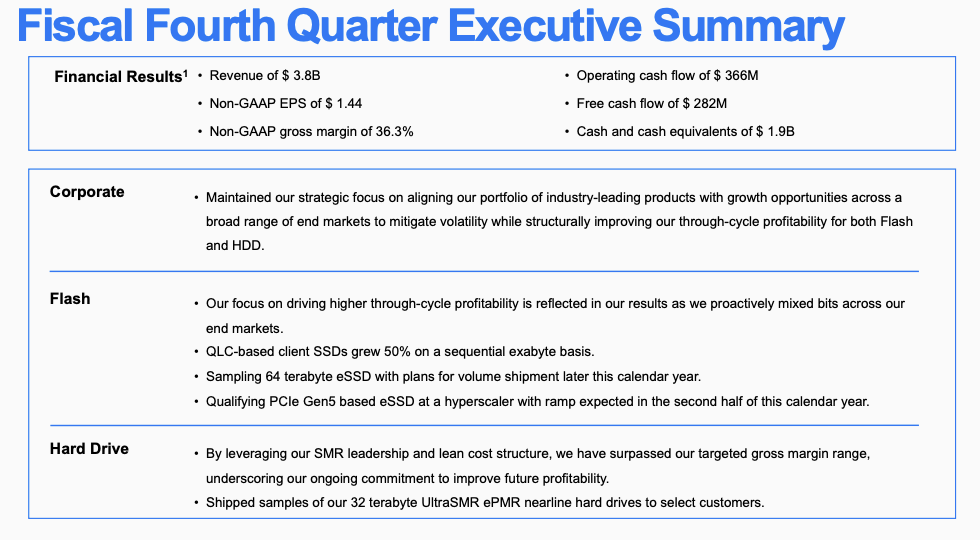

Western Digital reported strong earnings for its third quarter of fiscal 2024, with revenue reaching $3.5 billion, a non-GAAP gross margin of 29.3%, and non-GAAP earnings per share at $0.63. WD exceeded consensus estimates:

- Revenue: The company reported revenue of $3.5 billion, a 14% increase sequentially and a 23% increase year-over-year. This growth was driven by solid performance across all major business segments—cloud, client, and consumer.

- Non-GAAP Gross Margin: Its gross margin was 29.3%, significantly above guidance. Western Digital attributed this to better pricing, cost reduction efforts, and reduced underutilization charges. Flash gross margin was 27.4%, an increase of 19.5 percentage points sequentially, and HDD gross margin was 31.1%, up 6.3 percentage points.

- Non-GAAP Earnings Per Share: The non-GAAP earnings per share reached $0.63, exceeding expectations and signaling a return to profitability.

- Operating Cash Flow and Free Cash Flow: Operating cash flow was $58 million, while free cash flow was $91 million, indicating strong cash generation. Cash capital expenditures represented a cash inflow of $33 million due to property, plant, and equipment purchases.

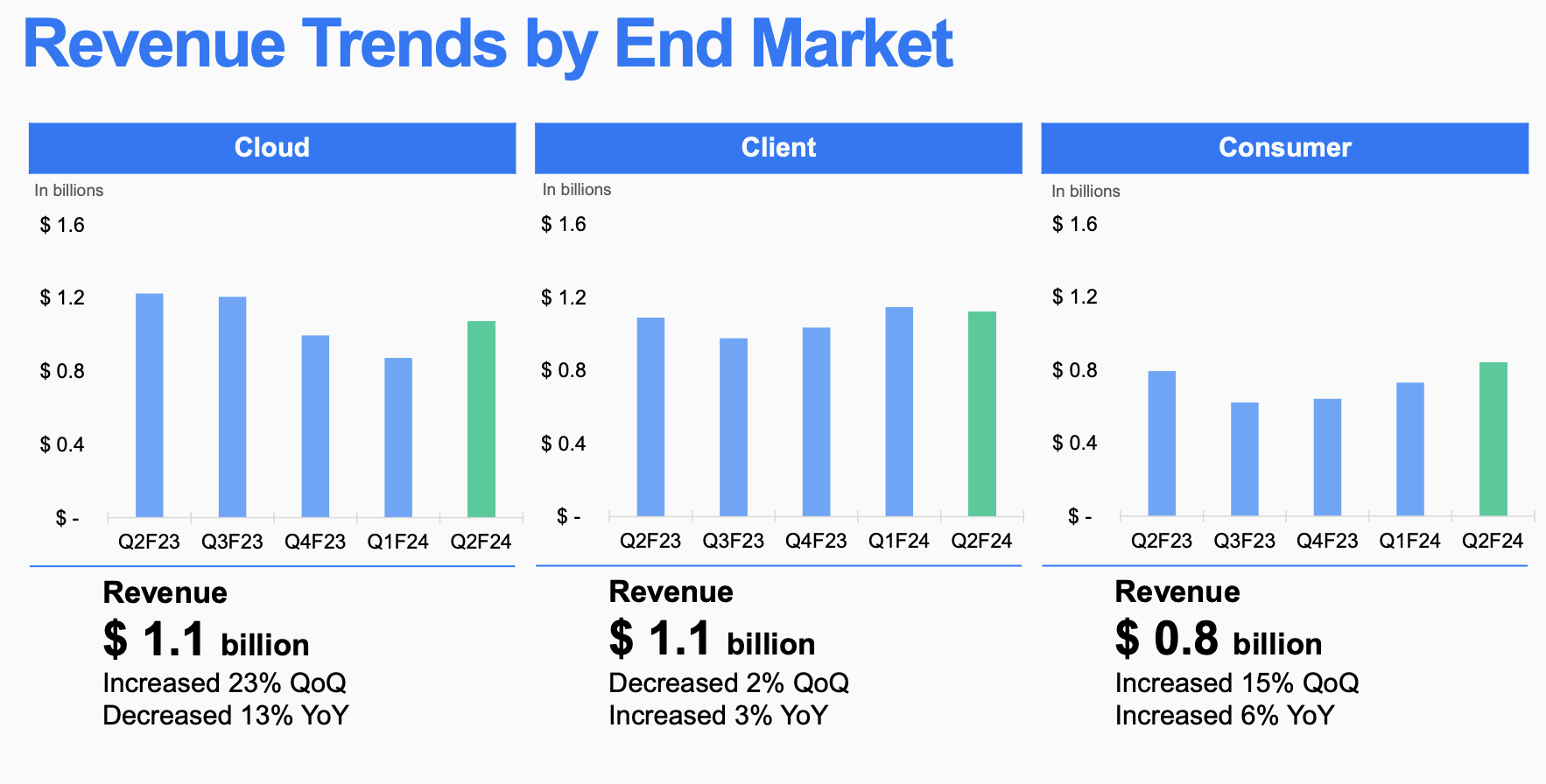

- Cloud Revenue: Cloud revenue, representing 45% of total revenue, reached $1.6 billion, up 45% sequentially and 29% year-over-year. Increased nearline shipments and improved pricing drove this growth.

- Client and Consumer Revenue: The client segment, representing 34% of total revenue, generated $1.2 billion, up 5% sequentially and 20% year-over-year. The consumer segment, making up 21% of total revenue, produced $0.7 billion, down 13% sequentially but up 7% year-over-year.

- Operational Expenses and Gross Debt: Operating expenses increased to $632 million, up 13% sequentially, mainly due to higher variable compensation. Gross debt outstanding was $7.8 billion, with cash and cash equivalents at $1.9 billion and total liquidity at $4.1 billion, including revolver capacity.

Key highlights of its earnings release include:

- Operational Improvements: Western Digital’s focus on operational efficiency and strategic business changes contributed to the improved earnings. The company’s diversification strategy and efforts to control costs helped drive profitability.

- Flash and HDD Businesses: Western Digital saw significant growth in its Flash and HDD businesses. Flash revenue increased with the mass production of QLC-based client SSDs and other innovations like BiCS6 and BiCS8. HDD revenue growth was supported by higher nearline demand, improved pricing, and advancements in UltraSMR technology.

- Long-Term Strategy: The company’s diversification of its product portfolio and focus on innovation and operational efficiency helped reduce business cycle impacts and improve long-term profitability. The separation of the Flash and HDD businesses is expected to complete in the second half of 2024.

Western Digital’s guidance for the fiscal fourth quarter suggests continued growth, with expected revenue between $3.6 billion and $3.8 billion and a non-GAAP gross margin of 32% to 34%. The company expects continued growth in HDD and Flash segments and plans to maintain capital discipline to support long-term profitability.

Analysis

Western Digital’s third-quarter earnings for fiscal 2024 show a solid recovery and promising growth trajectory, bolstered by strategic focus and operational efficiency.

Key drivers behind this performance include Western Digital’s diversified product portfolio and emphasis on operational efficiency. The company’s strong showing in the cloud segment, which accounted for 45% of total revenue, reflects the surge in demand for high-capacity storage solutions, particularly nearline HDDs. With 29% year-over-year growth in the cloud segment, Western Digital has demonstrated its ability to capture market share in an evolving landscape.

In its Flash segment, Western Digital’s strategic focus on disciplined capital spending and innovation is paying off. The company initiated mass production of its QLC-based client SSD using BiCS6 technology, and progress with BiCS8 is on track, reinforcing its leadership in flash technology. Additionally, the uptick in demand for enterprise SSD solutions, driven by AI-related workloads, is a significant growth opportunity that Western Digital is well-positioned to capitalize on.

Western Digital’s restructuring efforts and improved operational efficiency also bear fruit in the HDD segment. Higher nearline demand and improved pricing drove its 28% sequential revenue growth. The 19% increase in average price per unit reflects the company’s strategy to optimize profitability per exabyte sold. The continued success of UltraSMR technology and the anticipation of future advancements in nearline drives contribute to the company’s competitive edge.

Western Digital should be happy with its earnings, which reflect a shift toward higher profitability and long-term sustainability. The company’s focus on innovation, operational efficiency, and a diversified product portfolio bodes well for continued growth and enhanced shareholder value over the near term.