CoreWeave, the AI-focused cloud provider that’s that was early in catching and riding the generative AI boom, is officially gunning for the big leagues. The NVIDIA-backed company has filed for an IPO, looking to capitalize on the insatiable demand for AI compute.

That’s big news for the AI infrastructure world, where CoreWeave has rapidly positioned itself as a major player, taking on the likes of Amazon, Google, and Microsoft.

But before you start picturing ringing bells on Wall Street and champagne toasts, there’s more to the story. A lot more.

THE ACQUISITION PLAY: WEIGHTS & BIASES

Just two days after its IPO filing, CoreWeave made another bold move: acquiring Weights & Biases, a startup that provides machine learning tools for AI developers. The deal shows that CoreWeave isn’t just content with being the muscle behind AI workloads — it wants to own more of the developer ecosystem, too.

The acquisition is a strategic play, bundling AI infrastructure with development tools in a way that could make CoreWeave an even stickier choice for AI startups and enterprises alike. With NVIDIA’s blessing (and investment), CoreWeave has been moving aggressively to consolidate its hold on AI compute.

But just when things were looking like a dream run to Wall Street, the turbulence hit.

THE MICROSOFT MESS

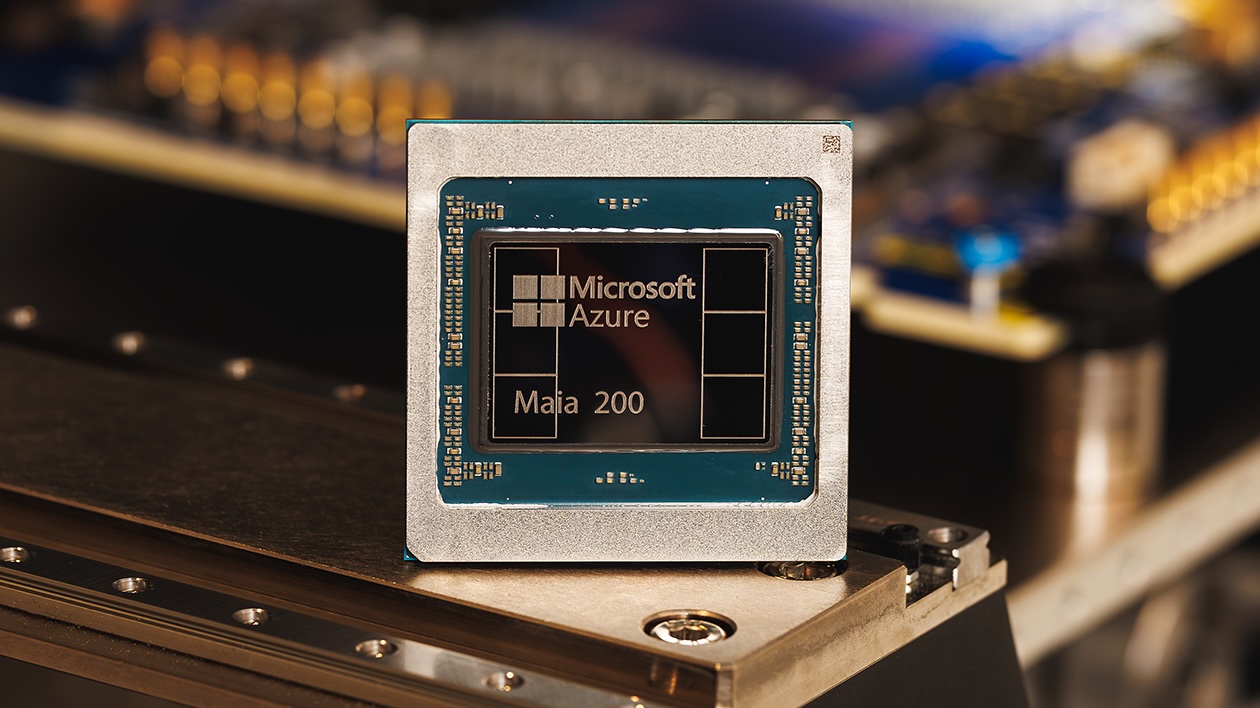

Just as things were looking good for CoreWeave, the Financial Times last week dropped a bombshell: Microsoft reportedly pulled back on some of its cloud agreements with CoreWeave over missed delivery commitments. That’s not the kind of headline you want when you’re about to ask public markets for billions. The report suggested that Microsoft, which had been a key customer, was rethinking just how much it wanted to bet on CoreWeave’s ability to scale.

CoreWeave, for its part, strongly disputes this. The company insists that Microsoft remains a major customer and that there are no significant contract disputes. Still, the mere fact that this issue is surfacing now — on the eve of an IPO — is enough to raise eyebrows.

THE BIGGER PICTURE

CoreWeave’s rapid ascent is emblematic of the AI cloud gold rush, where companies are scrambling to secure compute power for ever-growing AI models. NVIDIA has been a kingmaker in this space, and CoreWeave has been one of its biggest bets. But as the company tries to go public, the question is whether it can maintain its breakneck growth — and whether it can convince investors that its business model is more than just a high-stakes game of GPU arbitrage.

Microsoft’s alleged concerns (whether real or overblown) underscore a broader issue: AI infrastructure is a high-risk business. Demand is sky-high today, but the competitive landscape is shifting fast. AWS, Google Cloud, and even Oracle and Meta are all ramping up AI compute offerings, and hyperscalers aren’t going to let CoreWeave eat their lunch forever.

The coming weeks will be telling. If CoreWeave can smooth out the Microsoft drama and push ahead with its IPO, it has the potential to cement itself as a major force in AI infrastructure. But if investors start worrying about supply chain issues, contract risks, or the sustainability of its NVIDIA-dependent model, things could get bumpy fast.

One thing’s for sure: AI cloud is the hottest game in town, and CoreWeave is right in the thick of it.

Buckle up — this one’s far from over.