Background

Hewlett Packard Enterprise announced its HPE GreenLake Hybrid Cloud solution at HPE’s annual Discover conference in mid-2018. Antonio stood on stage in Las Vegas and told the world that HPE GreenLake would enable “a new consumption experience” for IT, bringing the operational and financial flexibility promised by the CSPs together with more traditional on-prem resources.

He told us that hybrid cloud is a reality for nearly every IT shop, and it’s time for the traditional OEMs to embrace that reality fully. Moreover, Antonio told us that this is Hewlett Packard Enterprise’s new future. He’d just bet the company on a new business model.

I remember clearly the jaded skepticism in the analyst room after the keynote. Few believed the company could pull off such a shift, one that impacted HPE’s culture as much as its products. HPE proved the skeptics wrong.

GreenLake Grows. And Pays Off

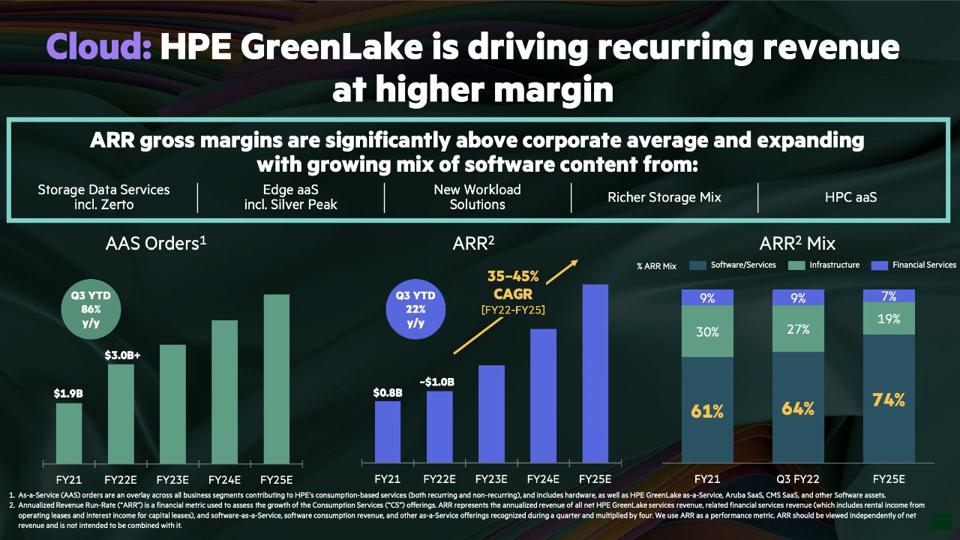

Antonio didn’t just promise HPE’s customers a new choice for hybrid cloud; he told HPE’s investors this was a high-growth, high-margin path to the future. He was right. GreenLake began paying off almost immediately.

By December 2018, HPE had grown GreenLake to 400 customers. In its most recent earnings call, HPE told us that the total annual recurring revenue for GreenLake reached $1B for the first time. The company isn’t sitting still, harboring strong projections for future growth.

HPE offered more statistics about GreenLake’s growth at its 2022 investor conference. HPE has grown from 400 customers in 2018 to more than 65,000 today. GreenLake has over 2 million connected devices and has more than an exabyte of data under management. More than 80% of HPE’s largest customers are using GreenLake.

Antonio said of GreenLake during the most recent HPE earnings call: “The relevance of HPE GreenLake with customers, combined with our disciplined execution, has propelled both ARR and our as-a-service total contract value higher. Over the last 2 years, we have more than doubled our as-a-service total contract value, reaching nearly $10 billion through the end of this quarter.”

News: OpsRamp Acquisition

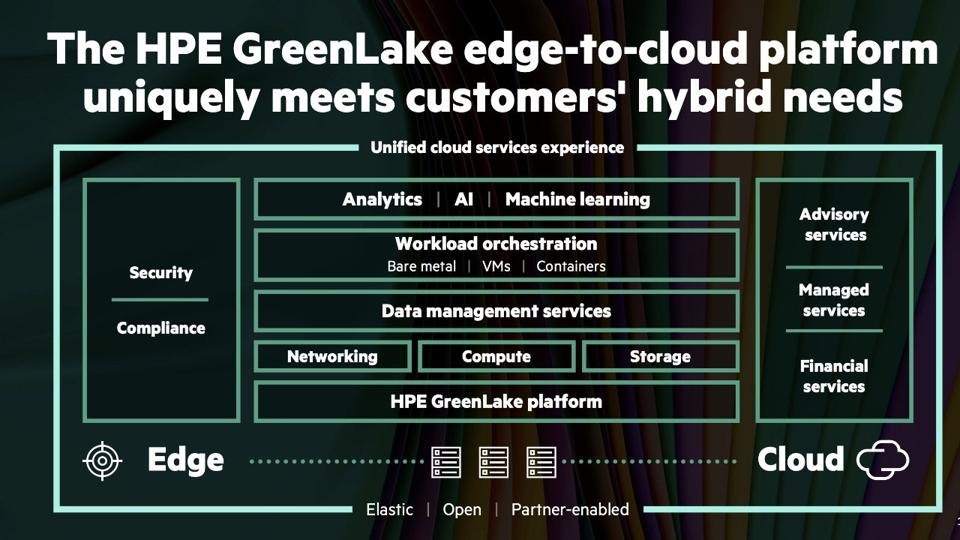

Delivering IT-as-a-Service requires more than just servers, storage, and networking. It also requires a robust set of software and services. These are necessary to give IT users a seamless experience in procuring, provisioning, and managing the underlying resources. This is a critical element of the GreenLake offering. HPE tells us that two-thirds of GreenLake’s revenue is software and services.

HPE has filled the gaps in its GreenLake offerings with an aggressive run of strategic acquisitions. Since announcing GreenLake in 2018, HPE has acquired nearly a dozen companies that directly contribute to GreenLake functionality. These include companies such as QuattroLabs, Scytale, CloudPhysics, Zerto, and Axis. This week HPE added to that list with its acquisition of OpsRamp.

Who is OpsRamp?

HPE this week announced the acquisition of OpsRamp for an undisclosed amount. OpsRamp was founded in 2014 to simplify the management of hybrid IT infrastructure. The OpsRamp solution leverages an industry-leading AIOps approach to monitor multi-cloud infrastructure and manage business-critical services.

OpsRamp helps IT organizations optimize services through automation and integration with ITSM and DevOps tools. These capabilities span multi-vendor computing, networking, storage, cloud resources, containers, virtual machines, and applications.

HPE tells us that it intends to integrate OpsRamp into GreenLake. HPE will leverage OpsRamp’s hybrid digital operations management solution with GreenLake to reduce the operational complexity of multi-vendor and multi-cloud IT environments in the public cloud, colocations, and on-premises.

Everybody’s As-a-Service

It’s hard to remember how forward-thinking HPE GreenLake was when it was announced. HPE was alone among the tier-one OEMs willing to undertake such a dramatic cultural shift to take control of its future. However, the company remains alone in putting a consumption-based subscription model as the cornerstone of its offerings.

The strong positive reaction to HPE GreenLake forced HPE’s competitors to follow suit. For example, Dell Technologies announced its Apex consumption-based offering in 2020, while Lenovo unveiled its comparable TruScale offering in 2021. Beyond compute, NetApp and Pure Storage also offer on-prem consumption-based storage offerings.

Analysis

HPE GreenLake is the benchmark for on-prem consumption-based infrastructure, a segment that is growing daily. Enterprises love the flexible economic and operational models that consumption-based infrastructure enables.

HPE’s CEO Antonio Neri bet the company’s future that enterprises would respond to the strategic shift. Enterprises have responded, and GreenLake is now a billion-dollar business. HPE’s continuing investments, such as this week’s acquisition of OpsRamp, demonstrate that the company is determined to evolve its offering to meet the growing demands of its customers at a level beyond its most direct competitors. HPE is well-positioned for continued success with GreenLake.