At Pure Accelerate, Pure Storage announced a new capacity-optimized scalable storage solution, new generations of its FlashArray storage products, new flash modules, and even new data resiliency SLAs in Evergreen//One. There’s a lot here that will make Pure’s customers happy. Its new capacity-optimized solutions should also give investors something to smile about.

Replacing HDDs with Flash

Pure Storage is on a mission to replace spinning hard drives by 2028. That was the underlying drumbeat Pure’s marketing teams laid down at the event. There were even executive interviews in the technology press ahead of the event, making that exact prediction. At the same time, nobody who follows the storage industry closely believes that the market for new enterprise HDDs is going away in five years.

What Pure Storage is demonstrating, though, is that it’s completely possible that the industry could make it happen. The technology and cost drivers for all-flash replacements to HDD solutions will exist, making it a compelling story.

Unfortunately, the problem for IT storage administrators is that players in the market, bigger than Pure, will keep that transition from happening. Ironically, that’s good news for Pure Storage, which is doing the right things to make its all-flash systems more attractive to buyers who might otherwise go with a competitor’s HDD-based solution.

Pure’s DirectFlash Module

Controlling your destiny in the all-flash storage business means controlling the capabilities of the flash storage media used in the array. Using off-the-shelf SSDs, as many storage vendors do, puts the flash-media providers in the driver’s seat for critical attributes such as managing endurance, performance, and even density. Moving some of these capabilities into the storage array’s operating system allows the storage vendor to better control the product it delivers, its features, and its cost.

Pure Storage is one of only two mainstream storage vendors that builds its storage modules (the other is IBM, which takes a different architectural approach to Pure’s). Pure Storage’s DirectFlash Module (DFM) enables Pure to deliver the most compelling alternative to enterprise HDD-based storage on the market, an alternative whose attractiveness is rapidly increasing.

At its Accelerate event, Pure announced its new 75TB DFM, giving Pure the highest-capacity flash storage device on the market. The company offers both TLC and QLC NAND-based versions of the device. But the story extends beyond just density, however.

Pure’s DirectFlash Module enables lower TCO by increasing density and reliability and lowering energy usage. Pure’s engineering teams have built a device that doesn’t just provide greater reliability and density compared to HDDs; it’s better than the off-the-shelf SSDs used by its competitors.

In a time of corporate sustainability metrics and where data centers consume up to 20% of an enterprise’s power budget, that’s compelling. Pure’s DFMe, which uses QLC-flash, also brings system-level per-gigabyte pricing to a point where it’s competitive with comparable HDD-based storage systems.

Pure is just getting started. As it pushes its agenda to replace new HDDs by 2028, one of the key claims is that density is increasing nearly as fast as costs are dropping. The company showed a chart predicting its DFM modules will approach 300TB of capacity in 2026. They went on to say that the price-per-gigabyte would be less than $0.15/GB.

Introducing FlashArray//E

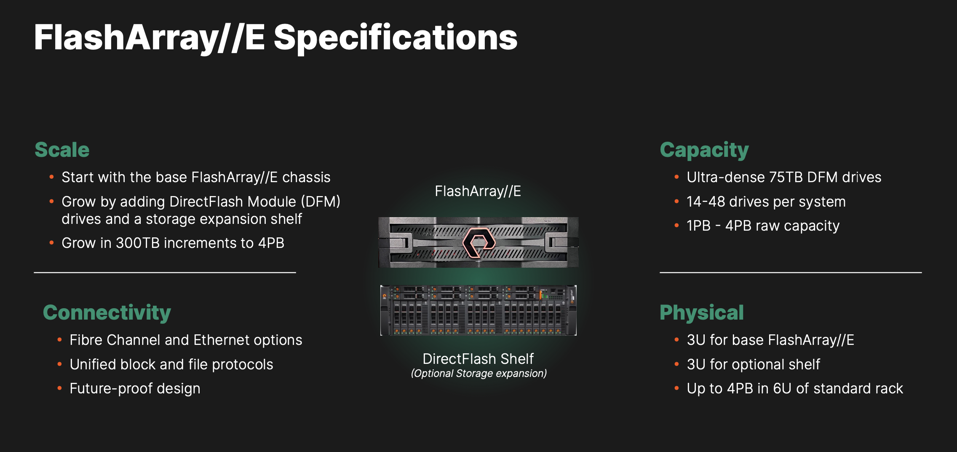

Pure is using its new 75TB DFM drives to build its new high-capacity FlashArray//E system, announced at Accelerate. The //E in the product name stands for “efficiency,” and it targets high-capacity data repository applications, a market dominated today by mechanical HDDs.

The FlashArray//E provides up to 4PB of effective capacity. Pure says the FlashArray//E comes in at less than $0.20/GB raw. Possessing up to 20 times higher capacity at one-fifth the space and power, along with 85% less e-waste and 40% lower TCO over six years, but at the same acquisition cost as all-disk storage, the Pure//E is very compelling.

The FlashArray//E follows the announcement earlier this year of its FlashBlade//E, which delivers even higher capacity into the same space. Where the FlashArray//E tops out at 4PB effective capacity, the FlashBlade//E will let you grow to up to 10PB.

Next Generation FlashArray//X & FlashArray//C

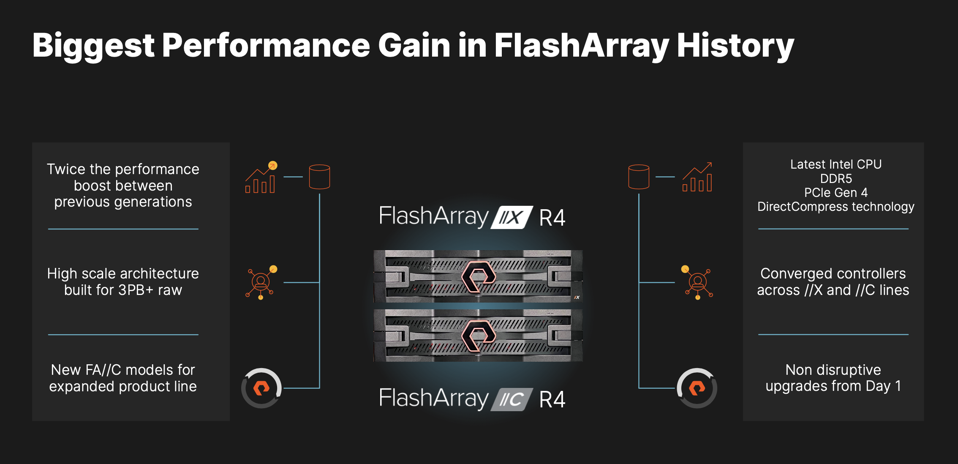

Pure Storage also announced the fourth generation (R4) of its FlashArray//X and FlashArray//C products. Combining its own architectural innovations with a generational leap in processor technology, the new R4 products deliver a 40% boost in overall performance, the highest generational change in Pure’s history.

Much of the performance boost arrives courtesy of Intel’s new Sapphire Rapid processors. The new fourth-generation Xeon processors bring PCIe 4.0 and DDR5 to Pure’s FlashArray. PCIe 4.0 doubles the speed of the array’s PCIe bus, while the adoption of DDR5 speeds memory access by up to 80%. Given that a storage array spends almost all its time moving data from one location to another, the performance increases should readily be apparent to users with high I/O demands.

Further performance gains can be achieved using Pure’s DirectCompress Accelerator, which the company introduced earlier this year. The accelerator offloads much of the array’s data compression workload to an FPGA-based device that handles the compression, freeing up the system’s processor for other tasks.

Data Resiliency SLAs for Evergreen//One

We’re amid a trend where vendors are moving cybersecurity features directly into devices that live in the infrastructure. We see that in networking gear, servers, and even processors. Recently that’s been extended to storage devices, with NetApp, IBM, and InfiniDat all announcing in-device anomaly detection (though each takes a slightly different approach). Pure Storage has joined that club with its new Data Resiliency SLAs for its Evergreen//One offering.

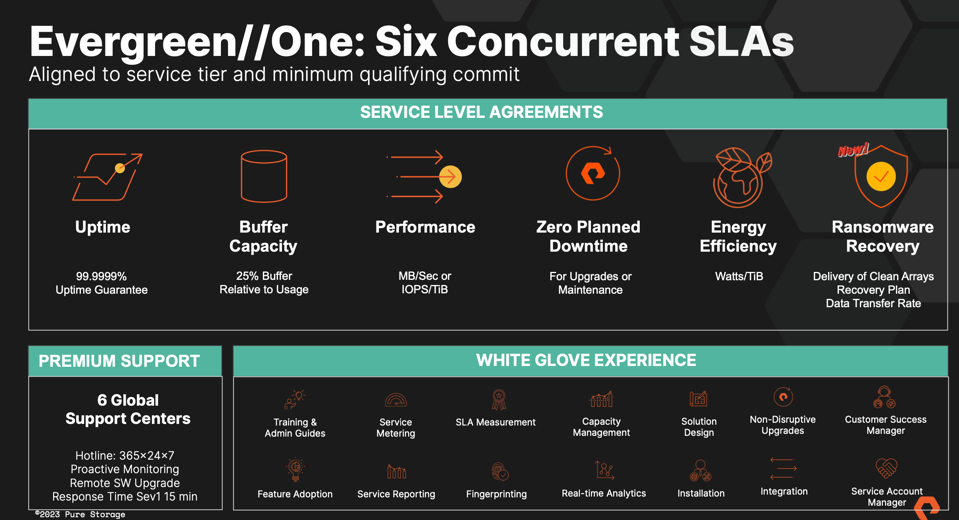

Evergreen//One is Pure’s cloud-like storage-as-a-service offering. Evergreen//One combines the agility and flexibility you expect from the public cloud but delivers with the security and performance that only an on-prem solution can provide.

Pure is introducing its new Data Resiliency SLA to Evergreen//One, bringing the total number of SLAs in the offering to six. The new Data Resiliency capability combines Pure’s “AI-driven anomaly detection” with an SLA that promises should a system become compromised, replacement equipment will ship within one business day, with a recovery plan finalized within 48 hours.

This makes Evergreen//One, already a compelling offering, even more attractive. We’re still in the early days of onboard anomaly detection for storage systems, but I’m hopeful that Pure will extend the functionality across its portfolio. Customers aren’t yet demanding this capability, and neither Hewlett Packard Enterprise and Dell Technologies offer it, but it’s something that will become more important over time.

Analysis

It’s no secret that I like Pure Storage. This isn’t because its technology is better than the competition (there are certainly areas where it isn’t), or that its vision is better than others. What I like most about Pure Storage is its relentless focus on simplifying the storage experience for IT administrators. Everything we do in the enterprise infrastructure space should make like easier for IT practitioners. Otherwise, you’re leaving the door open for a competitor who will – something Pure’s competitors have repeatedly learned.

Pure Storage is taking a very deliberate approach to expanding its market. It may look like a small bet to push QLC NAND into the near-line space, but Pure is betting its future on the ability to displace mechanical hard drives. Its//C and //E series products are expanding its market, stealing share from bigger vendors and nearly obsolete disk drive technologies. No tier-one storage vendor, except Pure Storage, can displace HDD-based systems without disrupting its own existing businesses. It will be a risky and expensive move for Pure’s larger competitors to follow, which will work to Pure’s advantage.

Pure Accelerate was a fun event. Pure’s customers are famously loyal, with the company maintaining a Net Promotor Score in the 80’s, which comes through at the in-person events. Pure now has a portfolio that dramatically expands the company’s serviceable market, continuing to expand as Pure innovates and leverages the power of its DirectFlash Modules. Pure Storage will not replace all new hard drives in five years, but I expect the company will take share from competitors that don’t also try.